2025 Breakthrough: Xion's USDC Gas Fees Simplify Web3 for Consumer Adoption

TL;DR

Xion has revolutionized Web3 UX by enabling gas payments in USDC. Users can now interact with dApps without wallets, seed phrases, or native token conversions. This model leads the push toward mass adoption, simplifies compliance, and sets a new standard for chain design. Backed by Circle, Multicoin, and Animoca, Xion is making crypto invisible and intuitive.

Why Gas Fees Hinder Web3 Adoption in 2025

Every blockchain transaction requires users to pay gas fees to incentivize validators. These fees are paid in the chain's native token. On Ethereum, that's ETH; on Solana, it's SOL. For non-native users, that's a UX nightmare. They must:

- Set up a wallet

- Buy the native token on an exchange

- Transfer it through a bridge or swap

- Hope it's enough to cover the fee

Each of those steps increases user churn. Research shows that 74% of new Web3 users never complete their first transaction, largely due to these friction points. Xion aims to change that by abstracting all this complexity.

Xion's Vision: Make Crypto Invisible

Xion positions itself as a walletless Layer-1 chain. Its architecture enables gas fees to be paid entirely in USDC, a widely used, regulated stablecoin issued by Circle.

This vision aligns with the next wave of crypto adoption, one where users interact with applications, not protocols. In this world, blockchain infrastructure should be invisible. Xion's abstraction eliminates crypto's technical drag, letting users focus on utility, not friction.

How USDC Gas Payments Work

Under Xion's model, when a user initiates a transaction, they:

- Interact with a Web2-like interface

- Pay the transaction fee directly in USDC

- Never touch or see the chain's native token ($XION)

How the Conversion Works (Behind the Scenes)

- Users sign the transaction using email, social login, or mobile authentication (WebAuthn).

- USDC is sent to a smart contract acting as a fee processor.

- The contract swaps USDC to $XION in the backend using decentralized liquidity protocols.

- $XION is sent to validators as native gas.

- The transaction is confirmed.

This swap process is fast, invisible, and economically efficient.

Smart-Contract Architecture Diagram

| Step | Action | Output |

|---|---|---|

| 1 | User triggers transaction with USDC | USDC sent |

| 2 | Smart contract auto-swaps USDC to $XION | Swap complete |

| 3 | $XION pays validator gas fees | Validator receives payment |

| 4 | USDC excess remains in pool or refunded | Transaction final |

Key Feature: Slippage controls are embedded using oracles, preventing overpaying or underpayment on volatile markets.

Generalized Abstraction: The UX Superpower

With generalized account abstraction, users don't need:

- Seed phrases

- Private key backups

- Native token balances

Accounts are created and controlled using smart contract wallets, not traditional private key pairs. This enables programmable account logic, including gas sponsorships, social recovery, and multisig access. It removes the intimidation and complexity that keep most users on the sidelines.

Why Xion's Model Converts 97% of Users

According to Xion's official announcement, their onboarding conversion rate hits 97%, compared to the 5%–10% industry average.

Conversion Rate Comparison Table

| Platform | Avg. First-Time Conversion Rate |

|---|---|

| Xion | 97% |

| MetaMask | 12% |

| Coinbase Wallet | 9% |

| Solana Mobile Wallet | 14% |

That performance is a testament to one thing: no native token, no friction.

Why Stablecoins Like USDC Work Better for Gas

USDC offers price stability and is widely adopted across exchanges and wallets. Its backing by U.S. Treasuries via Circle and BlackRock enhances trust. With Circle's recent IPO filing, the credibility of stablecoin gas becomes even stronger.

Other chains are catching on. MetaMask's integration with payment processors lets users pay gas in fiat via Stripe or PayPal, while PayPal's PYUSD supports stablecoin transactions and may integrate gas logic. But none offer chain-level integration like Xion.

Regulatory and Compliance Benefits

With MiCA (EU) and the pending U.S. stablecoin bill, the regulatory status of USDC is better understood than native tokens like AVAX or ADA. This regulatory clarity around stablecoins creates significant benefits for builders and apps:

- Easier tax reporting

- Better AML tracking

- Enterprise-grade integrations

This regulatory clarity could make Xion attractive for fintech and consumer brands seeking compliant blockchain solutions.

Xion vs. Other Account-Abstracted Chains

| Feature | Xion | Polygon CDK | zkSync Era | Base |

|---|---|---|---|---|

| USDC gas | ✅ | ❌ | ❌ | ❌ |

| Walletless UX | ✅ | Partial | Partial | ❌ |

| Email login | ✅ | ❌ | ❌ | ❌ |

| Compliance focused | ✅ | ❌ | ❌ | ❌ |

While others focus on speed or scalability, Xion bets on frictionless onboarding as the key to mass adoption.

$XION Tokenomics in a USDC-Powered World

Even with USDC gas, $XION remains crucial to the ecosystem. The token powers validator rewards, facilitates gas conversions, and defends against spam through anti-Sybil fees. Future demand could rise as more dApps integrate and swap volume grows, creating a sustainable economic model that benefits both users and validator networks.

Real-World Use Cases: What You Can Build

Xion's SDK lets developers launch applications across multiple sectors:

- Gaming: In-app purchases with USDC, no wallet setup required

- Loyalty Programs: Points redeemed as stablecoins with instant settlement

- E-commerce: Crypto checkout with traditional payment UX

Fiat on-ramps and WebAuthn authentication extend usability to mobile-native users, bringing Web3 functionality to mainstream applications.

Predictions: Will Native Gas Tokens Die by 2030?

By 2030, expect widespread adoption of multi-token gas options as chains compete for user-friendly experiences. Users will demand fiat-like UX in all dApps, and wallets will default to stablecoin transactions. Xion may be previewing what every Layer-1 will look like in the near future.

Final Thoughts: Invisible UX Is Inevitable

Xion's breakthrough proves that seamless UX, stable gas fees, and smart architecture can fundamentally redefine how blockchains are used. By making the underlying technology invisible, crypto is finally evolving from command-line complexity to consumer-ready simplicity. This shift represents more than just a technical improvement; it's the foundation for true mass adoption.

FAQs

How does Xion differ from traditional L1s?

Xion allows gas to be paid in USDC, removing the need for native tokens and wallets, creating a streamlined user experience comparable to Web2 applications.

What are the security protections in place?

Xion uses audited smart contracts, price oracles for slippage limits, and fallback protocols to handle edge cases like stablecoin de-pegs or liquidity shortages.

Will $XION lose value if gas is paid in USDC?

No. $XION remains essential for validator rewards, internal gas conversions, and network security, maintaining demand and ecosystem utility.

Can developers integrate Xion into their apps easily?

Yes. The SDK allows plug-and-play integration with Web2-style logins, USDC transactions, and existing dApp frameworks.

Is stablecoin-denominated gas the future of Web3?

As regulatory clarity grows and UX expectations increase, stablecoins will likely dominate both gas payments and transaction flows across the industry.

Kraken Launches 24/7 Tokenized-Stocks on Solana: What It Means for 2025

TL;DR:

Tokenized Stocks on Solana Are Changing Global Access to Equities Cryptocurrency exchange Kraken is preparing to roll out tokenized versions of over 50 major stocks and ETFs, including Apple and Tesla. Through its new xStocks platform, Kraken aims to offer global users 24/7 access to tokenized U.S. equities via the high-speed Solana blockchain, ushering in a new era of decentralized stock trading.

This aligns directly with Alpha Stake’s "Always-On Capital Markets" thesis: decentralize financial primitives, reduce latency, and unlock programmable liquidity across yield-generating digital assets.

Wall Street Meets Web3—Tokenized U.S. Stocks via Solana

Kraken launches its tokenized stocks product with 50+ U.S. equities, including Tesla and Nvidia, using SPL tokens on Solana. These tokenized versions will enable users to trade fractional shares around the clock, outside of Wall Street hours.

Users via Solana can trade tokenized shares backed 1:1 by equities held by Backed Finance, a Swiss-regulated SPV. While Kraken’s xStocks are geo-fenced from U.S. residents, non-U.S. investors across Latin America, Europe, and Asia gain instant access to decentralized stock trading.

For Alpha Stake, this tokenized stock trading ecosystem enhances our validator economy thesis and provides new primitives for RWA integration.

Quick-Hit Facts: Kraken to Offer Tokenized Equities

| Item | Detail |

|---|---|

| Launch Window | Q3 2025 (beta live for non-U.S. users) |

| Coverage | 50+ major stocks and ETFs, including Tesla, Nvidia, SPY, GLD |

| Blockchain | Solana SPL tokens; 400 ms blocks, sub-cent fees |

| Asset Backing | 1:1 shares custodied by Backed Finance (Swiss SPV) |

| Geography | Global users outside the U.S. (Europe, LatAm, Asia, Africa) |

How Kraken's xStocks Work

Mint-Redeem Mechanism: Tokenized shares are minted through Kraken's platform. Real equities are custodied by Backed Finance, converted into SPL tokens on Solana, and redeemed by verified users at fair value.

Always-On Liquidity: The Solana blockchain's sub-second finality and low fees enable real-time execution. Kraken’s order book serves as a central liquidity hub, with potential extensions into DeFi lending pools and automated market makers.

Regulated Access: Tokenized US stocks are only transferable between KYC’d wallets in approved jurisdictions. This structure mirrors traditional tokenized securities but operates entirely on decentralized rails.

Why Kraken Selected Solana for Tokenized US Stocks

- Finality & Scale: Solana offers <500 ms finality and $0.00025 average transaction costs—critical for equities trading.

- Token Metadata & Compliance: Solana supports built-in freeze authority, whitelisting, and corporate action automation.

- Network Gravity: Solana already hosts Franklin Templeton tokenized Treasuries, Visa's USDC pilot, and Firedancer’s validator infrastructure.

Alpha Stake’s validator operations directly benefit from expanded network throughput and transaction fees.

Competitive Landscape & Regulatory Questions

- Prior Failures: Binance’s stock tokens were halted in 2021 after warnings from BaFin.

- Kraken’s Workaround: By issuing tokens through a Swiss SPV and excluding U.S. users, Kraken aims to avoid regulatory pitfalls.

- TradFi's Response: JPMorgan, BlackRock, and Citi are exploring similar offerings on private ledgers. Regulatory clarity from the GENIUS Act could influence adoption timelines.

How LPs Benefit from Tokenized Stocks via Solana

- Capital Efficiency: Swap idle stablecoins for tokenized SPY to earn fees or supply them into lending pools.

- DeFi Collateralization: Use BTC to collateralize tokenized stock exposure, reducing volatility-adjusted risk.

- Cross-Time Arbitrage: Exploit NAV divergence across time zones, creating low-risk alpha.

- Validator Yield Boost: More token activity = higher validator earnings. Alpha Stake’s nodes capture the upside.

Risks of Tokenized Stock Trading on Solana

- SPV Failure Risk: Custodial risk remains centralized in Backed Finance.

- Liquidity Fragmentation: CEX/DEX split may create price inefficiencies.

- Regulatory Drift: Tokenized equities are still in a gray zone in the U.S.

- Solana Downtime: Solana’s outages and exploit history are unresolved threats.

Alpha Stake Fund’s Strategic View on xStocks

Kraken plans to launch tokenized U.S. stocks via Solana at scale, reinforcing Alpha Stake’s conviction in decentralized market infrastructure. This move bridges traditional finance with decentralized finance (DeFi), unlocking yield streams for LPs.

Alpha Stake is conducting full due diligence, custody reviews, oracle feed testing, and jurisdictional mapping. Our RWA sleeve may allocate up to 25% to tokenized assets depending on volatility, compliance, and validator incentives.

Conclusion: Kraken Launches xStocks on Solana—DeFi Meets TradFi

Exchange Kraken is preparing to launch tokenized U.S. equities that let users trade tokenized stocks around the clock. From Tesla to SPY, this isn’t a pilot, it’s a new product standard for global digital asset portfolios.

If you’re an LP ready to align validator yields with tokenized equity access, book a call with Alpha Stake.

Explore more:

Why the 2025 Stablecoin Surge Is Forcing Banks to Adapt to Crypto

TL;DR

In 2025, stablecoins are no longer fringe, they’re core infrastructure for global payment systems and crypto trading. U.S. legislation is about to authorize both banks and fintechs to issue stablecoins via the GENIUS and STABLE Acts. Major banks are reacting, but regional banks could gain ground if they move fast. This moment is a decisive break from traditional banking and a realignment of how capital flows.

Regulatory Clarity on Stablecoin Issuers Is Finally Here

The GENIUS Act and STABLE Act will define how stablecoins operate legally in the U.S. Both laws establish a dual-track system for stablecoin issuance, open to banks and fintechs, requiring 1:1 fiat or high-quality liquid asset reserves. The new rules prohibit stablecoins from bearing yield, keeping them from competing with traditional bank accounts.

This regulatory framework balances systemic safety with competitive access and removes ambiguity that has long held back stablecoin adoption.

Big Banks Are Launching Stablecoins, But the Clock Is Ticking

Major banks—JPMorgan, Citi, Wells Fargo, and Bank of America, are quietly developing a shared stablecoin platform. The goal is to control cross-border payments, domestic settlement, and retail transfers before stablecoins like USDC dominate those channels. The strategy is defensive, an effort to keep customer capital inside traditional apps while mimicking crypto UX.

But this effort is reactive. It doesn’t offer meaningful innovation in payment rails. It simply delays the inevitable rise of programmable money.

2025 Is the Year Regional Banks Could Win With Stablecoin Adoption

The GENIUS Act enables state-chartered banks to issue stablecoins without waiting for federal review, if their balance sheets remain under $10B. That puts local institutions in a unique position to compete directly with fintechs.

Small banks now have three advantages:

-

Fast, low-fee payments globally

-

New deposit-style token models

Issuing a stablecoin isn’t just a defensive tactic, it’s a leap forward into modern banking infrastructure.

Stablecoin Payment Rails Are Replacing Traditional Payment Networks

Stablecoins settle instantly, without reliance on SWIFT or ACH. They’re programmable, trackable, and auditable. Businesses are using them for payroll, e-commerce, treasury operations, and even tokenized settlement.

Real-world use cases now include:

-

Cross-border payroll in USDC

-

Treasury balances in DAI

-

E-commerce platforms using crypto wallets

Legacy Deposit Models Are Under Direct Threat

What happens when consumers can hold a dollar-pegged asset, transfer it instantly, and never step foot in a bank? The traditional deposit model collapses. That’s why the banking lobby demanded the ban on yield-bearing stablecoins in the STABLE Act.

If these coins offered yield, banks would hemorrhage deposits. The stablecoin market is already big, allowing it to grow without oversight would have removed banks from the core of capital formation.

Global Stablecoin Regulation Is Moving Faster Than U.S. Policymakers

While the U.S. debates legislation, the EU implemented its Markets in Crypto-Assets (MiCA), licensing Circle for issuance. Japan approved tokenized yen products, and Hong Kong is rolling out a sandbox for fintech-led stablecoin products.

This gap is dangerous. If American firms can’t issue compliant stablecoins soon, global crypto capital will shift abroad.

Alpha Stake’s Stablecoin Strategy: Liquidity and Tactical Yield Optimization

Alpha Stake allocates up to 25% of its portfolio to stablecoins. Not just to hedge, but to maximize tactical liquidity. Weekly NAV recalculations let us rebalance dynamically, and stablecoin pools provide investors inter-quarter access.

Key advantages:

-

Capital preservation during high volatility

-

Tactical entry into validator and staking infrastructure

This isn’t theoretical. It’s the core of how our capital flow policy works under high-frequency market stress.

Key Terms to Know in the 2025 Stablecoin Market

| Term | Definition |

|---|---|

| Stablecoin | A crypto asset pegged to a fiat currency like USD |

| USDC | A fully-reserved dollar token issued by Circle |

| GENIUS Act | U.S. legislative proposal for bank and state-led stablecoin issuance |

| Stablecoin Issuer | Entity allowed to issue dollar-pegged assets under regulation |

| Payment System | Infrastructure handling transactions and settlements |

| Peg | 1:1 value anchoring a stablecoin to its reference currency |

Conclusion: The Stablecoin Era Has Arrived. Who Leads It?

Stablecoins are reshaping money, payments, and capital markets. Banks are no longer at the center of innovation; protocols are. Regional and community banks can still lead, but only if they issue stablecoins, adopt programmable infrastructure, and embrace token-based liquidity.

This is the start of a new financial cycle. Those who adapt will thrive. Those who delay will be forgotten.

FAQs

Are stablecoins legal under U.S. law in 2025?

Yes. The GENIUS and STABLE Acts create a framework for issuance by banks and fintechs with strict compliance rules.

What’s the risk to traditional banks?

Deposits are migrating to tokenized dollars, shrinking their balance sheets and relevance.

What stablecoins does Alpha Stake use?

We primarily hold USDC, DAI, and FRAX to balance liquidity, decentralization, and regulatory flexibility.

Will stablecoins ever offer yield?

Not in the U.S. under current rules. However, DeFi structures still enable synthetic yield.

Can a community bank launch a stablecoin?

Yes. Under the GENIUS Act, if their AUM is under $10B, they can issue directly under state oversight.

Moody’s 2025 Credit Downgrade Triggers Institutional Shift Toward Bitcoin

TLDR:

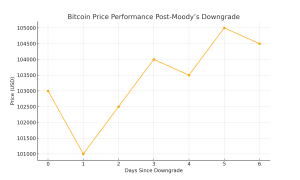

Moody’s downgraded the U.S. credit rating from Aaa to Aa1 on May 16, 2025, marking the end of the United States’ triple-A era. The downgrade follows earlier actions by Fitch and S&P, citing rising government debt, persistent deficits, and a deteriorating credit profile. The crypto market, particularly Bitcoin, responded with resilience, as investors increasingly rotate into decentralized assets amid growing distrust in sovereign creditworthiness.

Downgrade by Moody's on May 16: A New Era in Sovereign Credit Risk

The decision to downgrade the U.S. from Aaa to Aa1 represents a historical inflection point. It is the first time in modern financial markets that all three major credit rating agencies—Moody’s, S&P, and Fitch—have removed the United States’ AAA rating. The downgrade announcement highlighted not only the sheer size of U.S. debt but the structural deterioration in fiscal metrics.

Moody’s Analytics cited mounting debt and interest payments as a percentage of GDP, an erosion in debt affordability, and political dysfunction within U.S. administrations and Congress as key reasons. This credit downgrade of the United States' sovereign credit rating is more than symbolic; it confirms a long-standing decline in U.S. credit strengths.

Credit Rating Fallout: From AAA to AA1 Amid Fiscal Deterioration

The downgrade of the U.S. credit rating by Moody’s placed a spotlight on the country’s large annual fiscal deficits and long-term trajectory of government debt and interest obligations. The rating agencies pointed to a deteriorating credit rating from Aaa, citing weakening credit profile metrics. As a result, the United States’ credit score is no longer pristine.

The downgrade of the US credit rating followed similar steps by Fitch and S&P, who cited similar concerns, reinforcing the consensus among rating agencies. The one-notch downgrade may appear minor numerically but carries weight across global markets and reserve allocation strategies.

Reaction in Traditional and Crypto Markets: Gold, Treasuries, and Bitcoin Diverge

Following the downgrade, treasury yields climbed sharply. The 30-year Treasury yield touched 5%, signaling increased risk premiums. Stocks pulled back modestly; the S&P 500 declined over 1% on the week, showing restrained but real concern. Traditional markets saw shifts in allocations, particularly away from long-duration U.S. Treasuries.

In contrast, gold reached a new all-time high above $3,200/oz before stabilizing. But the more significant story was Bitcoin.

Bitcoin weathered the downgrade announcement with strength. While initially dipping with broader risk assets, BTC stabilized above $100,000 and soon resumed its trend. The crypto market, long viewed as speculative, showed signs of maturation. This performance strengthens the argument for Bitcoin as a hedge in periods of sovereign risk and financial market uncertainty.

Bitcoin's Role in a Post-Downgrade World

The downgrade of the US prompted renewed attention on decentralized assets. Bitcoin’s fixed supply and independence from central bank manipulation make it an attractive hedge against both inflation and fiscal instability. As the U.S. government faces long-term debt service pressure, institutional investors are diversifying into non-sovereign assets.

ETF data post-downgrade confirms this trend. More than $300 million in inflows were recorded across spot Bitcoin ETFs in the week following the downgrade. BlackRock’s iShares Bitcoin Trust (IBIT) has crossed $23 billion in AUM, driven by allocators seeking exposure to hard assets.

This rotation mirrors historical trends following sovereign credit downgrades: capital seeks refuge in assets not tied to any one nation’s liabilities. The impact on crypto markets has been foundational — Bitcoin is no longer simply a growth asset; it’s a macro hedge.

On-Chain Data Signals Accumulation

On-chain analytics post-downgrade show reduced BTC balances on exchanges and rising long-term holder supply. Whale inflows to Binance fell by over 50% from prior months, and many high-net-worth wallets shifted coins to cold storage. These patterns align with past accumulation phases.

Realized profits remain high, yet coins are not moving to exchanges, indicating conviction. The declining exchange supply also suggests reduced sell pressure.

Sovereign Credit Downgrade Reshapes Risk Allocation

For institutional investors, the recent downgrade has forced a recalibration of risk models. A lower sovereign credit rating on U.S. debt means recalculating treasury risk premiums. The downgrade of the United States' credit rating and the loss of the AAA rating directly influence long-term forecasts.

Family offices and macro hedge funds have cited the downgrade of the US as a turning point. Large-scale shifts in allocation models now consider Bitcoin alongside gold and short-duration Treasuries.

Government Debt, Fiscal Policy, and Bitcoin's Ascent

The deterioration in fiscal metrics, driven by years of large annual deficits, has created a structural concern. U.S. debt has now surpassed $36 trillion, and interest payments are consuming an increasing share of government revenue. The deterioration in debt affordability undermines confidence in long-term fiscal sustainability.

Rating agencies flagged the growth in deficits and the inability of U.S. administrations and Congress to implement long-term solutions. The downgrade by Moody's on May 16 was the culmination of these concerns. Moody’s ratings downgraded the United States' credit score, assigning it an AA1 rating and citing an unsustainable path forward.

Bitcoin’s rise is linked directly to this fiscal deterioration. The more unstable the fiat system becomes, the more attractive decentralized assets appear.

Conclusion: Bitcoin Steps Into the Macro Arena

Moody’s downgrade of the U.S. credit rating has prompted investors to reassess their exposure to sovereign risk. Gold, inflation-linked bonds, and Bitcoin are increasingly used for diversification. The crypto market, particularly Bitcoin, is gaining relevance as a hedge against debt and inflation concerns.

Bitcoin’s reduced correlation with equities and stronger link to inflation expectations have positioned it as part of a broader defensive allocation. This reflects a broader shift in portfolio construction.

Part 3-World Network's Economic Thesis: Beyond Proof, Toward Productivity

TL;DR

- Worldcoin’s next frontier is real economic use: identity-verified remittances, decentralized labor platforms, and programmable payments.

- The convergence of stablecoins, AI, and PoP infrastructure enables low-friction, high-trust interactions—especially in markets with weak financial institutions.

- Ethereum L2s and apps that integrate World ID could unlock new crypto-native economic primitives.

- Alpha Stake sees opportunity in second-order tokens, rails, and protocols that will settle around verified personhood networks.

World Network's Economic Thesis

For World Network (Worldcoin) to scale beyond the hype, the project must connect identity verification to real-world capital flows. That’s already in motion.

Use Case 1: Remittance & Diaspora Payments

Stablecoins + World ID can enable compliant, biometric-secured cross-border transfers. Unlike traditional banks, they don’t require passports or trust in local fiat rails. Think KYC via iris scan.

According to Worldcoin Foundation, the World App will soon support biometric-secured transfers between Latin America, Sub-Saharan Africa, and Southeast Asia using low-fee stablecoins like USDC.

Use Case 2: AI-Powered Labor Markets

PoP-verified task marketplaces can reduce fraud and bot saturation in gig economies. AI agents working alongside verified humans (and DAOs) create new programmable labor primitives.

This lines up with Alpha Stake’s framework on DePIN and AI-agent markets.

Use Case 3: Programmable Welfare / UBI Experiments

Worldcoin’s UBI vision hasn’t died, it’s just shifted. Airdrops, subsidies, and DAO-based public goods projects could use verified identity to issue programmable welfare or micro-loans.

As detailed in the Worldcoin Whitepaper, universal basic income becomes a programmable currency layer that adapts to network participation.

The Strategic Role of Ethereum & Layer 2s

Worldcoin operates atop Ethereum. Its L2, World Chain, uses OP Stack to optimize for human-centric sequencing—where verified users get priority and spam is minimized.

Ethereum’s Strength in Identity Interoperability

- Many credential protocols (like Gitcoin Passport, BrightID) already exist.

- World ID could integrate into broader cross-chain Web3 identity.

- Ethereum’s validator set gives Worldcoin a secure, censorship-resistant base layer.

Vitalik Buterin still sees potential: “We need scalable civil-resistance infrastructure. World ID might be one.”

Risk and Reward: Where Capital Flows Next

Alpha Stake is watching second-order ecosystems: what gets built on top of World Network infrastructure—not just WLD.

Key Targets:

- Stablecoin facilitators that embed World ID for compliance

- Labor DAOs that require PoP to join

- Remittance aggregators offering biometric on-ramps

- DePIN layers that use PoP to allocate bandwidth or compute

- Lending protocols like Morpho Labs building identity-secured decentralized credit markets

Final Thoughts: What World Network Could Become

If the World project proves identity primitives can support large-scale economic flows—without compromising privacy, it could define the next wave of crypto-native applications.

As CoinDesk reports, Worldcoin is already partnering with platforms like Visa and Tinder to explore biometric verification in payments and social interactions.

But success depends on execution: will users, regulators, and developers trust the system enough to build real economies on top of a biometric ledger?

How Coinbase's x402 Protocol Is Rewiring Internet Payments in 2025

TLDR

Coinbase has ignited the machine-to-machine economy by launching x402, a protocol that allows AI agents to make instant, on-chain USDC payments using the long-dormant HTTP 402 “Payment Required” code. No credit cards, no APIs, no KYC. Just pure protocol-level value transfer.

Coinbase Revives HTTP 402 to Power Web3’s Autonomous Economy

HTTP 402 was designed in the early internet era but left unused. Now, Coinbase has retooled it into x402, a protocol turning stablecoin payments into first-class citizens of the web itself.

With x402, AI systems and autonomous software can send payments as easily as they send data. It eliminates legacy rails: no credit cards, API keys, or identity verification. Just a few lines of code and a Web3 wallet.

“We’re doing for value what HTTPS did for security,” says Coinbase Developer Platform head Erik Reppel.

The First-Ever AI-to-AI Crypto Payment Has Happened

On August 30, 2024, two large language models executed a real, verifiable, autonomous USDC transaction, without human involvement. One bot paid another for access to compute resources.

This wasn’t a demo. It was the first live example of an AI-native financial transaction: permissionless, programmable, and immutable.

This confirms what Cointelegraph and CryptoSlate speculated: x402 is not theoretical. It’s operational.

Why x402 Matters for Blockchain Investors and Builders

Coinbase’s x402 protocol brings:

- Stablecoin-native HTTP payments

- No KYC or bank rails

- Autonomous AI agent participation in financial markets

- Real-time, trustless value exchange over the web

This is programmable commerce at the protocol level. It compresses the entire financial stack, merchant onboarding, identity, payment gateways, into a single interaction between two machines using stablecoins like USDC.

It unlocks machine-scale use cases:

- AI bots paying per API call

- Compute marketplaces transacted in real-time

- Micropayment-based web services

- Self-paying smart contracts

- Dynamic subscription services

Stablecoins Power the Machine Economy

The choice of USDC wasn’t accidental. USDC is programmable, fully backed, and audit-friendly. Machines need stability, not volatility, for automated payments. x402 leans heavily on USDC’s predictability and low-friction integrations.

🔗 Related: Stablecoins Unleashed: The Pillars of Tomorrow’s Financial Infrastructure

Machine-to-Machine Payments Require New Rails

Legacy systems, bank accounts, APIs, card networks, were never meant for machines. x402 solves five critical bottlenecks:

| Constraint | Legacy System | x402 Protocol |

|---|---|---|

| ID verification | Requires KYC | None |

| Developer effort | Complex API calls | Simple HTTP status code |

| Geographic limits | Region-restricted | Borderless |

| Speed | 1–3 days | Instant |

| Control | Centralized gateways | Permissionless |

Just as HTTPS encrypted the web, x402 natively embeds payments into the protocol layer. And like TCP/IP abstracted global communication, x402 abstracts global settlement.

What This Means for Crypto Allocators and Builders

The x402 era forces re-evaluation of your positioning. Key verticals likely to benefit:

| Sector | Strategic x402 Benefit |

|---|---|

| Stablecoin Infrastructure | More USDC velocity, validator-based settlement |

| Layer 1 Chains | Protocols with fast, deterministic finality win |

| DePIN & Validators | Autonomous payments for compute, bandwidth, and storage |

| Dev Tools | Demand for plug-and-play x402 integrations |

| AI-Enabled DeFi | Bots that pay, trade, and earn autonomously |

🔗 Related: Ethereum’s Validator Economy and the Rise of DePIN Infrastructure

x402 + AI = Internet-Native Commerce

The convergence of AI and crypto isn’t hype, it’s the infrastructure layer of a new economy. Here’s how AI needs crypto:

- Monetization of API and inference outputs

- Settlement rails for autonomous tasks

- Secure recordkeeping for agent interactions

- Identity-free global transactions

And crypto needs AI:

- Intelligent automation of DeFi strategies

- Pricing algorithms, arbitrage engines, liquidity routing

- Real-time data procurement and governance voting

🔗 Related: The Convergence of Bitcoin and AI: How DeFi Is Fueling Autonomous Agents

Developer Integration: Stupid Simple

import { x402 } from '@coinbase/x402';

const endpoint = x402.createEndpoint({

amount: "1.00",

currency: "USDC",

description: "real-time compute"

});

endpoint.on('payment', async (payment) => {

if (await payment.verify()) {

return { status: 200, body: { token: accessToken() } };

}

});

Any API, AI inference model, or SaaS endpoint can become a self-paying service with less code than Stripe.

Emerging Use Cases Already Live

- LLMs auto-paying for prompt data

- DAOs compensating open-source devs

- Bots paying validators for bandwidth and storage

- Micro-paywalls without subscriptions

- IoT sensors auto-funding themselves via x402 endpoints

🔗 Related: Understanding World Networks Infrastructure: Strategic Roadmap Part 1

FAQs: Coinbase x402 and the Future of Payments

What is x402?

The Coinbase protocol revitalizes HTTP 402 to integrate cryptocurrency payments directly into internet infrastructure, employing stablecoins such as USDC.

How is it different from crypto payments today?

No wallet integrations or APIs. Payments happen over HTTP, directly between machines—autonomously.

Which stablecoins are supported?

USDC now, but the protocol can support any compliant, verifiable stablecoin.

Can this disrupt Stripe, Plaid, or traditional finance?

Yes, if x402 scales, it bypasses the card network altogether for machine-native commerce.

What Should Investors Do Next?

- Monitor networks integrating x402 endpoints

- Track Layer 1s and validators facilitating AI payments

- Allocate to stablecoin infrastructure and DePIN models

- Prioritize teams building autonomous economic agents

🔗 Related: Part 3: Stablecoins as Global Capital Infrastructure

Want to know which validator economies and yield-bearing assets are x402-ready?

Contact Alpha Stake to explore strategic positions for the machine-to-machine internet.

Let me know if you'd like this converted into HTML for CMS or published as a long-form PDF whitepaper.

Part 2-Worldcoin’s Privacy Architecture Was Always the Risk

TL;DR

- Worldcoin isn’t just a crypto experiment—it’s a global test of biometric identity, data privacy, and regulatory resilience in the Web3 era.

- Ethereum’s Vitalik Buterin called it “the most serious attempt at proof of personhood,” but its reliance on iris scans, biometric data, and centralized hardware raises major privacy concerns.

- This part unpacks what regulators think about Worldcoin’s data collection and how Alpha Stake frames biometric risk in its capital allocation model.

- Worldcoin’s success hinges not just on technology but on user privacy, trust, and compliance with global data protection regulations.

- Alpha Stake’s approach to allocating capital to biometric-based crypto assets considers global enforcement trends, centralization bottlenecks, and long-tail policy outcomes.

Worldcoin’s Privacy Architecture Was Always the Risk

While Worldcoin presents a bold vision of decentralized identity, its dependency on biometric iris scans makes it an anomaly in a crypto space built on minimizing personal data exposure. The project insists on consent, local image destruction, and encrypted deduplication. But regulators—and privacy advocates—see structural flaws.

In interviews with MIT Technology Review and the EFF, users in Kenya and Chile revealed they didn’t fully understand what they were consenting to. In Spain, Worldcoin was forced to halt orb operations after allegations that biometric collection violated EU purpose-limitation standards.

Iris Scan Consent Workflow Under Scrutiny

“Worldcoin’s architecture captures biometric data before consent is obtained—this alone should disqualify it under most modern privacy frameworks.” — EFF

The core of the problem lies in the order of operations:

- Orb scans the iris

- Biometric is encoded into a unique hash

- User is then asked to accept terms

Critics argue that real consent can’t follow data capture.

Worldcoin argues that the iris scan is not retained unless a user opts in, and the final identity hash—based on a unique iris code—is non-reversible. But legal definitions of consent vary across jurisdictions. According to Worldcoin, consent can be revoked at any time, but privacy advocates argue that scanning before acceptance violates GDPR and similar data protection regulations.

Regulator Actions Against Worldcoin (2023–2025)

“Some users said they were unaware their iris scans were being stored or repurposed for AI training.” — MIT Technology Review

- Spain (Oct 2023): Temporary suspension by data protection agency

- Kenya (Dec 2023): National ban citing lack of transparency

- South Korea (Jan 2024): Ongoing investigation under biometric privacy act

- Hong Kong (May 2024): Issued cease-and-desist citing “excessive data collection”

Even jurisdictions open to crypto—like South Korea—are skeptical when it comes to biometric verification. This has direct implications for the scalability of Worldcoin’s verification network.

Worldcoin Hardware Centralization vs Web3 Values

Tools for Humanity controls Orb production, firmware, iris model training, and MPC backend infrastructure. This presents a core contradiction:

- The Orb is the only on-ramp to World ID

- The entire stack is vertically integrated

If TFH becomes compromised—technically or politically—the network has no fallback verification mechanism. For Alpha Stake, this raises red flags around centralization risk, vendor lock-in, and resilience to geopolitical pressure.

Capital Allocation Strategy for Biometric Data Protocols

We treat biometric identity plays like WLD as high-convexity, binary-outcome exposure. The probability of success is low—but the payout profile is asymmetrically large.

Our internal framework considers:

- Legal momentum: How fast regulators are moving in key markets

- Infrastructure decentralization: Can identity verification be disaggregated?

- Monopoly surface area: Who controls the rails (hardware, app, key issuance)?

- Token dependency: Can the token still accrue value if verification slows?

This mirrors how we’ve assessed other controversial primitives like Trump’s Strategic Bitcoin Reserve or DePIN platforms discussed in Ethereum’s Validator Economy.

What the Worldcoin Privacy Backlash Teaches Web3 Investors

The core tension is between inclusion and surveillance. Worldcoin aims to verify 1 billion people—but to do that, it must scale across legal regimes that demand very different privacy guarantees.

Biometric crypto is not going away, but Alpha Stake LPs should expect volatility, risk repricing, and waves of political pushback. Exposure should be scaled accordingly.

The Future of Worldcoin, AI, and Digital Currency Infrastructure

In Part 3, we’ll explore how the intersection of stablecoins, AI agents, and digital ID infrastructure opens up new remittance rails, labor markets, and decentralized capital flows in the Worldcoin orbit.

Sui Ecosystem 2025: Explosive Growth, Token Innovation, and Decentralized Expansion

TLDR

The Sui ecosystem surged in 2024 and early 2025, positioning itself as one of the fastest-growing blockchain networks. Major protocol upgrades, a thriving DeFi ecosystem, cross-chain innovations, and a vibrant NFT marketplace expanded Sui’s market cap, attracting institutional and retail adoption. With smart contract advancements and liquidity expansion, Sui in 2025 is set to redefine what users and developers expect from a Layer 1 blockchain.

Introduction

Built on the vision of scalable, high-performance blockchain technology, Sui's ecosystem evolution from its early 2023 launch to early 2025 is remarkable. With cutting-edge parallel transaction execution and a vibrant DeFi landscape, Sui continues to decentralize its network and unlock new opportunities across multiple sectors. This report explores Sui blockchain innovations, its expanding market cap in April 2025, and the projects building on Sui that will define its next growth phase.

Sui Blockchain Architecture and Protocol Developments

The Sui blockchain, developed by Mysten Labs, deploys a novel object-centric data model allowing transactions to be processed in parallel. This design offers high throughput and low latency, making Sui one of the most efficient Layer 1 blockchain networks. Key protocol upgrades from 2024 through early 2025 include:

- Sui Move Prover: Formal verification tooling enhanced Sui smart contracts’ security.

- Dynamic Fields: Expanding the capabilities of smart contracts to store and manage complex, mutable data.

- Sponsored Transactions: Gas fee innovations allowing dApps to subsidize user costs, enhancing accessibility.

The future where Sui’s core engine empowers mainstream blockchain adoption is actively being built today.

Ecosystem Growth: Key Metrics and Milestones

| Metric | April 2024 | January 2025 | April 2025 |

|---|---|---|---|

| TVL (Total Value Locked) | ~$250M | >$2B | ~$1.5B |

| Unique Addresses | 30M+ | 67M+ | 70M+ |

| Cumulative Transactions | 320M+ | 560M+ | 600M+ |

| Native Stablecoins | 0 | 4 | 4+ |

Sui's DeFi ecosystem matured rapidly with native stablecoins like USDC, crUSD, and crEUR gaining traction. Notably, the Sui Bridge enabled seamless cross-chain liquidity from Ethereum and Circle's CCTP, solidifying Sui’s role within the broader crypto ecosystem.

DeFi Protocol Innovation Within the Sui Ecosystem

Defi protocols on Sui such as SuiSwap, Navi Lending, and Scallop Finance grew exponentially through late 2024 into 2025. Flash loan mechanisms, automated market makers (AMMs), and structured lending solutions highlighted Sui's ability to support sophisticated DeFi strategies. The Alpha Stake Fund Overview noted that Sui’s liquidity improvements and transaction scalability positioned it among the top blockchain platforms for DeFi innovation.

DeFi Highlights:

- TVL peak of ~$2B in January 2025.

- Over $160M in stablecoin liquidity by year-end 2024.

- Major DEX integrations unlocking new yield farming and staking strategies.

Real-World Applications and On-Chain Expansion

Beyond DeFi, Sui's ecosystem growth expanded into gaming, NFTs, and cross-chain protocols:

- SuiPlay0x1: Blockchain-native handheld console designed to bring Sui gaming dApps to the masses.

- Native Bridges: Cross-chain integrations connecting Ethereum assets to the Sui network.

- Enterprise Solutions: Discussions around Sui-based payment solutions with Stripe and other fintechs by early 2025.

With the Alpha Stake Liquidity Strategy supporting Sui’s on-chain asset growth, the blockchain ecosystem demonstrated real-world viability far beyond simple speculation.

Sui Tokenomics and Market Dynamics

Sui tokenomics, anchored by a capped supply of 10 billion SUI tokens, provided clear monetary policy guidance. As of April 2025:

- Circulating supply reached ~52%.

- Annual staking rewards stabilized around 7%.

- Protocol revenues began offsetting issuance inflation, strengthening token value capture models.

Sui token holders can stake SUI to participate in decentralizing the Sui network and earn validator rewards, making it attractive for both retail and institutional token holders.

Sui Price Prediction and Market Cap in April 2025

With a price prediction ranging between $2.00–$3.50 by end-2025, Sui’s market cap in April 2025 approached $7 billion. Analysts attribute this to strong liquidity improvements, institutional onboarding, and a rapidly diversifying protocol ecosystem.

Despite fluctuations, Sui remains among the top Layer 1 blockchain contenders, offering robust price forecast potential as it continues its global expansion.

What to Expect from Sui in 2025 and Beyond

Ecosystem Expansion

Expect significant ecosystem expansion fueled by:

- New DeFi protocols.

- NFT marketplaces.

- Decentralized gaming platforms.

On-Chain Upgrades

Upcoming upgrades will include modular smart contract enhancements and improved validator node client performance, driving more adoption.

Global Decentralization

Sui's foundation remains focused on decentralizing validator participation and increasing geographic diversity among node operators by late 2025.

The entire ecosystem is designed to make building on Sui seamless for developers and frictionless for users.

Conclusion

2025 will prove that Sui can bypass the endless congestion and scaling limitations of traditional Layer 1 blockchains. The combination of smart contract flexibility, low transaction costs, and thriving liquidity pools position Sui for dominance. Whether through DeFi, NFTs, gaming, or tokenized payments, Sui’s ecosystem growth trajectory remains explosive.

Sui in 2025 unlocks a future of borderless, decentralized, and highly scalable blockchain adoption, bringing Sui to the masses and ensuring its place among the top Layer 1 blockchains for years to come.

Solana Ecosystem 2024 thru2025: Resilient Growth, Record ETFs, and Firedancer Future

TLDR

Solana roared back in 2024–2025 with record-setting DeFi activity, institutional ETFs, major technology breakthroughs like Firedancer, and unprecedented ecosystem growth. Institutional capital is accelerating, network reliability is stronger, and Solana's influence within the blockchain ecosystem continues expanding, setting the stage for the future of Solana.

Introduction

Solana’s rebound after the 2023 collapse exemplifies why it remains a top blockchain platform. Solana's ecosystem expansion, driven by DeFi, DePIN, and NFT projects, elevated SOL back into the spotlight. This report explores the state of the Solana blockchain ecosystem, price predictions, and the future of Solana in 2025 and beyond.

Solana Blockchain Architecture and Technology

Firedancer Validator Client

Firedancer, built by Jump Crypto, is a critical component for Solana in 2025. Firedancer’s high transaction speed and low latency unlocks over 1 million transactions per second, positioning Solana as the blockchain technology leader.

Localized Fee Markets

Launched in 2024, localized fee markets on the Solana network prevent network-wide congestion, ensuring high throughput and low fees even during major NFT drops or memecoin booms.

Confidential Transfers

Confidential Transfers built on Solana blockchain introduce privacy-centric solutions without compromising regulatory compliance, critical for institutional adoption.

Solana offers one of the highest-performing blockchain ecosystems in 2025, maintaining high throughput and low costs compared to rivals.

Solana Ecosystem Growth: Metrics and Highlights

| Metric | Jan 2024 | Jan 2025 | Apr 2025 |

|---|---|---|---|

| TVL | ~$3B | $12.1B | ~$7–8B |

| DEX Volume | ~$7B | $90B (peak) | $11B |

| Validators | 2,000+ | 2,500+ | 2,500+ |

| Memecoin Market Cap | — | $25B+ | ~$15B |

- Solana’s TVL quadrupled year-over-year.

- Top 10 Solana projects like Jupiter Exchange and Drift Protocol drove surging liquidity.

- Validator expansion boosted network decentralization.

- Visa integrations accelerated real-world adoption.

Trends in the Solana Ecosystem: DeFi Boom and Memecoin Volatility

- Solana dApps in DeFi like Drift Protocol processed $20B+ monthly.

- Memecoins catalyzed volatile but lucrative trading.

- Flash Trade emerged as a top Solana DEX.

Solana’s DeFi ecosystem demonstrated resilience, growing sophisticated despite 2025’s market corrections.

Real-World Usage: DePIN and Infrastructure Expansion

- Helium’s decentralized 5G networks and Hivemapper’s mapping surged.

- Render Network scaled GPU compute built on Solana blockchain.

- New projects like Pulse Wearables expanded NFT projects on Solana into consumer tech.

The innovation within the Solana ecosystem reflects the growing ecosystem of projects designed for real-world applications.

Institutional Adoption: ETFs and Finance on Solana

- Canadian SOL ETFs from Purpose and CI gathered CA$250M+.

- Franklin Templeton tokenized $350M assets on Solana blockchain.

- Visa’s Solana Pay integrations boosted adoption.

Institutional interest in Solana solidified Solana's price prediction trends favoring strong growth through 2025 and beyond.

Developer Ecosystem Expansion

- Hackathons attracted 10,000+ developers across the Solana community.

- Ecosystem funding hit $173M in Q3 2024.

- Tools built on Solana now emphasize security and performance.

Projects on Solana like Superteam and grants from the Solana Foundation supercharge future ecosystem growth.

Network Stability and High Throughput Improvements

- Localized fees and v1.16 upgrades achieved 99.98% uptime.

- Transactions per second sustained record levels.

- Firedancer's April 2025 testnet launch marked a leap in network resilience.

Solana Price Forecast and SOL Predictions for 2025

Top analysts' Solana price forecast indicates $180–$300 potential by Q4 2025 based on ETF flows, DeFi ecosystem expansion, and top Solana projects growth.

- Sol price fluctuated sharply post-memecoin mania.

- April 2025 stabilized SOL around $110, setting up bullish scenarios.

- Price predictions hinge on Firedancer success and U.S. ETF approvals.

SOL remains a top blockchain asset with a strong price forecast through 2025 and beyond.

Future of the Solana Blockchain Ecosystem

Firedancer Rollout

- Boosted sustainable transactions per second.

- Lowered validator hardware costs by 30%.

- Improved Solana's ability to compete with Ethereum L2s.

U.S. ETF Potential

- BlackRock and Grayscale SOL ETFs pending approval.

- Forecast for the SOL price post-approval: explosive upside.

Cross-Chain and DeFi Integration

- Wormhole bridges expanded interoperability.

- New Solana dApps fostered multi-chain asset flow.

The future of Solana promises increasing adoption, powerful blockchain technology upgrades, and dominant DeFi infrastructure.

Conclusion

Solana’s ecosystem growth in 2025 proves it can scale, innovate, and capture institutional adoption. With a high transaction speed and low fees, Solana continues to offer an efficient blockchain platform, rivaling Ethereum and other L1s. As Solana Labs and the Solana Foundation deliver key upgrades like Firedancer, and as institutional interest in Solana deepens, SOL’s future remains bright.

The state of the Solana ecosystem in 2025 reflects resilience, massive opportunity, and the foundation for lasting blockchain leadership.

FAQs

What is Firedancer and why is it important?

Firedancer optimizes Solana's validator operations for unmatched speed and reliability, securing its future as a top blockchain.

How did memecoin mania affect Solana?

Memecoin surges boosted short-term TVL and DEX volumes but matured the Solana DeFi ecosystem after inevitable corrections.

Are ETFs crucial for Solana’s price prediction?

Yes. ETFs drive institutional adoption and liquidity, solidifying positive Solana price forecasts.

Is Solana’s network still facing issues?

No. Solana blockchain stability now exceeds 99.98% uptime thanks to 2024–2025 upgrades.

How competitive is Solana versus Ethereum L2s?

Solana offers high throughput and low fees natively on Layer 1, versus fragmented liquidity across Ethereum rollups.

What industries are adopting Solana?

Financial services, gaming, DeFi projects, and DePIN real-world infrastructure are the fastest adopters across the Solana ecosystem.

Part 3-Institutional Adoption & Strategic Rotations: Stablecoins as Global Capital Infrastructure (2025)

TL;DR

Institutional capital is flowing into stablecoin strategies faster than ever. This final chapter in our stablecoin series explores how regulated funds, treasuries, and sovereign-grade financial players are retooling balance sheets, liquidity strategies, and compliance protocols to integrate stablecoins into everyday operations. Learn how capital rotations, treasury stacking, and new market infrastructure are transforming stablecoins from yield tools into monetary infrastructure.

From Crypto Curious to Stablecoin Committed

Corporations, fund managers, and banks have transitioned from stablecoin experimentation to full integration. Catalysts include:

- Full SEC guidance for "Covered Stablecoins"

- Legislative clarity via the GENIUS and STABLE Acts

- Global regulatory frameworks like MiCA (EU), MAS (Singapore), and JFSA (Japan)

Stablecoins have become balance-sheet credible, with U.S. banks piloting USDC rails and EU institutions rotating into tokenized Treasury products like BUIDL.

Capital Rotation: Stablecoins as Liquidity Hubs

Major funds now treat stablecoins as cash equivalents with programmable yield capabilities. Examples include:

- Hedge funds allocating 5–20% of NAV to stablecoin yield strategies

- Venture capital firms disbursing capital via USDC for transparency and speed

- Corporate treasurers utilizing tokenized Treasuries as digital bond proxies

- FX desks executing cross-border payments via stablecoin swaps

Liquidity is no longer synonymous with idle fiat. It’s about portable, composable, regulatory-compliant digital dollars.

Treasury Stacking and DAO-Level Reserve Strategy

Advanced treasury strategies mirror multi-asset portfolios, blending liquidity, yield, and governance exposure:

| Treasury Layer | Assets Used | Objective |

|---|---|---|

| Base Liquidity | USDC, PYUSD | Immediate spend + cross-border |

| Yield Layer | sUSDe, LP Tokens | Operational yield generation |

| Safe Reserves | BUIDL, OUSG | Regulatory clarity + steady yield |

| Strategic Assets | veCRV, vlCVX, YT Tokens | Long-term governance influence |

DAOs and institutional treasuries deploy these blended stacks to optimize resilience and flexibility.

What Institutions Demand from Stablecoin Infrastructure

To pass institutional due diligence, platforms must provide:

- Institutional custody integrations (e.g., Anchorage, Fireblocks)

- Embedded KYC/AML compliance layers

- Real-time settlement proofs and auditability

- Tax reporting support (via platforms like TaxBit or Lukka)

Protocols lacking these standards are increasingly excluded from institutional capital flows.

Where Capital is Flowing in 2025

| Destination | Capital Source | Primary Reason |

|---|---|---|

| BUIDL / OUSG | Corporate treasuries, banks | On-chain Treasury exposure |

| USDC + PYUSD | Fintechs, payment rails | Fast, regulated cross-border payments |

| DAI / sUSDe | DAOs, DeFi-native hedge funds | High yield, composability |

| Tokenized Credit | RWA platforms (Goldfinch, Maple) | SME lending, non-correlated yield |

Stablecoins are now treated like diversified FX reserves, not speculative assets.

Compliance Arbitrage is Over: Cross-Jurisdictional Alignment

Offshoring strategies and regulatory arbitrage are becoming obsolete:

- U.S.: Covered stablecoins are exempt from SEC registration but under strict reserve mandates.

- EU: MiCA compliance is mandatory for exchange listings and corporate payments.

- Asia: Licensing regimes in Singapore, Japan, and Hong Kong enable sandboxed usage.

Funds now deploy geo-fenced wallets and adjust exposures monthly based on evolving regulatory maps.

Tactical Rotations: How Funds Rebalance Stablecoin Allocations

Rebalancing strategies under new compliance regimes include:

- Reducing USDT exposure in European portfolios post-MiCA

- Increasing PYUSD allocations for U.S.-based payment apps

- Rotating from DAI to BUIDL for reserve stability

Sample Portfolio: Post-Regulatory Rebalance (Q3 2025)

| Token/Instrument | Allocation % | Notes |

|---|---|---|

| USDC | 35% | Base cash + integrations |

| PYUSD | 20% | Payments and remittances |

| BUIDL | 15% | Tokenized Treasury exposure |

| sUSDe | 10% | High-yield tactical play |

| OUSG | 10% | Safe reserve yield |

| veCRV / vlCVX | 5% | Strategic governance exposure |

| DAI | 5% | Legacy integrations |

Fintechs and Payment Rail Integration

Stablecoins are increasingly embedded into payment and settlement infrastructure:

- PayPal + PYUSD: Supporting gig economy and SME cross-border payments.

- Stripe + USDC: Enabling merchant settlements for platforms and freelancers.

- Visa + Circle: Stablecoin APIs driving programmable payment solutions.

These integrations accelerate stablecoin adoption far beyond crypto-native platforms.

DeFi Protocols Are Institutionalizing

To attract regulated capital, DeFi platforms are:

- Launching KYC-enabled liquidity pools (e.g., Clearpool, Maple Pro)

- Wrapping liquidity tokens with compliance layers (e.g., Centrifuge's Tinlake)

- Auditing reserves and smart contracts to Tier 1 standards

Expect DeFi’s institutional share of capital to grow rapidly as compliance tooling matures.

The Rise of Digital Treasuries

Beyond stablecoins, institutions are building programmable treasuries composed of:

- Tokenized cash (USDC, PYUSD)

- Tokenized Treasuries (BUIDL, OUSG)

- Smart contract-enabled budget allocation and reporting

These infrastructures deliver real-time visibility, proof of reserves, and automated compliance — a major leap beyond traditional banking.

Macro Trend: Digital Dollars Replace Legacy Banking Tools

| Legacy Banking Tool | Replaced By |

|---|---|

| Corporate Checking | USDC Wallet + Treasury APIs |

| FX Hedging | Multi-Stablecoin Treasury Stacks |

| Cross-Border Payroll | PYUSD-based payment rails |

| Short-Duration Bonds | Tokenized Treasury Pools |

| Repo Agreements | Smart contract real-time settlements |

Financial workflows are being upgraded to fully digital, programmable systems.

Conclusion: Stablecoins Are Now Global Settlement Infrastructure

Stablecoins have officially transitioned from yield tools to core monetary infrastructure. For funds, corporations, and treasuries, the path forward is clear:

- Adapt treasury strategies to incorporate programmable cash

- Diversify stablecoin holdings across compliant jurisdictions

- Automate compliance, liquidity, and yield management

In 2025 and beyond, stablecoins are not just assets. They are infrastructure, programmable liquidity, and trustless settlement layers for a globalized digital economy.

FAQs

What makes a stablecoin institution-grade?

Full reserve backing, regulatory licensing, independent audits, and custodial integrations.

Can stablecoins replace corporate bank accounts?

Yes, for cross-border payments, short-term reserves, and programmable treasury operations.

How do funds manage regulatory divergence?

Through geo-fenced wallets, jurisdiction-specific exposures, and dynamic monthly rebalancing.

Are DeFi protocols ready for institutional investors?

Top-tier protocols with KYC pools, insurance, and Tier 1 audits are rapidly becoming institution-ready.

What’s the next frontier for stablecoins?

Total financial automation through smart contract-controlled digital treasuries.

Ready to Build Your Digital Treasury Strategy?

Book a call with Eric Kazee, General Partner at Alpha Stake, and unlock personalized insights into stablecoin integration, compliance, and yield optimization for your portfolio.