The Convergence of AI and Cryptocurrency: A Trend Driven by Wright's Law

TLDR:

- AI and Cryptocurrency Convergence: AI and cryptocurrency are integrating, driven by Wright's Law, which predicts cost reductions as production scales. This convergence is poised to revolutionize finance, healthcare, supply chain management, and the energy sector.

- Benefits: The merger promises advances across various industries, including AI-driven financial services, secure patient data in healthcare, optimized logistics, and energy distribution.

- Autonomous Economic Agents (AEAs): These AI-driven agents will execute transactions and manage digital assets autonomously on blockchain networks, creating new economic models.

- Future Trends: Expect increased adoption, transformations across industries, enhanced privacy, and the democratization of AI through decentralized platforms.

- Wright's Law Influence: As production scales, costs will decrease, accelerating the adoption and development of AI and cryptocurrency technologies.

Introduction

Imagine a world where financial transactions are not just secure and transparent, but also intelligent and adaptive. This isn't science fiction—it's the promise of the convergence between artificial intelligence (AI) and cryptocurrency. As these two groundbreaking technologies intertwine, they're set to reshape our digital landscape in ways we're only beginning to comprehend.

This article explores the exciting intersection of AI and cryptocurrency, examining how Wright's Law is driving their integration and what it means for our future. We'll delve into the benefits, challenges, and emerging trends that are defining this technological revolution.

Understanding the Convergence

Defining the Players

Artificial Intelligence (AI) refers to computer systems capable of performing tasks that typically require human intelligence. These include learning, problem-solving, and pattern recognition1.

Cryptocurrency is a form of digital or virtual currency that uses cryptography for security and operates independently of central banks.

Wright's Law: The Engine of Progress

At the heart of this convergence lies Wright's Law, a principle that states for every cumulative doubling in production, costs decrease by a constant percentage. In the context of AI and cryptocurrency:

- As AI hardware production increases, costs fall, making AI more accessible.

- As blockchain networks process more transactions, the cost per transaction decreases, enhancing crypto viability.

- The more people use these technologies, the more efficient and cost-effective they become.

AI-Enhanced Cryptocurrency

- Market Analysis: AI algorithms can process vast amounts of data to identify trading opportunities and trends. For example, platforms like Numerai use AI to crowdsource hedge fund strategies.

- Fraud Detection: Machine learning models can spot unusual patterns in transactions. Chainalysis, a blockchain analysis company, uses AI to detect and prevent cryptocurrency fraud.

- Personalized Investment Strategies: AI can create tailored investment plans based on individual risk profiles. Platforms like Wealthfront are already using AI to optimize crypto portfolios.

Cryptocurrency Empowering AI

- Decentralized Infrastructure: Blockchain provides a secure, transparent framework for AI applications. SingularityNET, for instance, aims to create a decentralized marketplace for AI services.

- Data Integrity: The immutable nature of blockchain ensures the reliability of data used by AI systems. Projects like Ocean Protocol are working to create a decentralized data exchange to support AI development.

- Tokenization of AI: Crypto tokens can incentivize AI development and improvement. Fetch.ai is pioneering this approach, creating an ecosystem where AI agents can autonomously trade digital assets.

Benefits and Opportunities

The convergence of AI and cryptocurrency promises to revolutionize various industries:

- Finance: AI-driven financial services using cryptocurrencies could transform lending, insurance, and asset management. Imagine smart contracts that automatically adjust interest rates based on real-time market conditions.

- Healthcare: Blockchain could secure patient data while AI analyzes it to improve diagnoses and treatment plans. MedRec, an MIT project, is exploring this potential1.

- Supply Chain Management: AI-optimized logistics combined with blockchain-based tracking could dramatically increase efficiency and transparency. Walmart is already using blockchain to track food supply, and AI could further enhance this system.

- Energy Sector: AI could optimize energy distribution on decentralized grids, with transactions facilitated by cryptocurrencies. The Brooklyn Microgrid project is an early example of this concept in action.

Predictions and Future Trends

Increased Adoption:

As AI costs decrease, more individuals and institutions will embrace cryptocurrencies. AI-driven applications tailored for the crypto ecosystem, such as advanced trading bots and user-friendly interfaces, will become more widespread.

Transformations Across Industries:

The merger of AI and crypto is expected to significantly impact various sectors:

- Finance: Automated, AI-driven financial services using cryptocurrencies could revolutionize lending, insurance, and asset management.

- Healthcare: Blockchain could secure patient data, while AI analyzes it to improve diagnoses and treatment plans.

- Supply Chain Management: AI-optimized logistics combined with blockchain-based tracking could dramatically increase efficiency and transparency.

- Energy Sector: AI could optimize energy distribution on decentralized grids, with transactions facilitated by cryptocurrencies.

Enhanced Privacy and Security:

Advanced methods will protect data and enable new forms of collaboration.

a) Homomorphic Encryption:

This advanced cryptographic technique allows computations to be performed on encrypted data without decrypting it first. In the context of AI and crypto:

- AI models can analyze encrypted data, maintaining privacy while still deriving insights.

- Financial institutions could process cryptocurrency transactions without exposing the underlying data.

- Secure multi-party computation becomes possible, allowing multiple parties to jointly compute a function over their inputs while keeping those inputs private.

b) Zero-Knowledge Proofs:

This cryptographic method allows one party (the prover) to prove to another party (the verifier) that a statement is true without revealing any information beyond the validity of the statement itself. Applications in AI and crypto include:

- Verifying the integrity of AI model outputs without revealing the model's proprietary structure.

- Proving ownership or the right to use a cryptocurrency without revealing the actual balance or transaction history.

- Validating the correctness of complex computations in privacy-preserving machine learning.

c) Federated Learning:

This machine learning technique enables training AI models on decentralized data. When combined with blockchain:

- Multiple parties can collaboratively train AI models without sharing raw data.

- The blockchain can serve as an immutable ledger of model updates, ensuring transparency and auditability.

- Crypto tokens can incentivize high-quality data contributions to improve model performance.

d) Differential Privacy:

This statistical technique adds controlled noise to datasets, making it difficult to extract information about any specific individual. In the AI-crypto space:

- Blockchain networks can implement differentially private mechanisms to protect user transaction patterns.

- AI models can be trained on sensitive data with guaranteed privacy bounds.

- Cryptocurrency wallets can obscure transaction amounts while still allowing for network validation.

e) Secure Enclaves and Trusted Execution Environments (TEEs):

These hardware-based security solutions create isolated environments for processing sensitive data. In the context of AI and crypto:

- AI computations can be performed within secure enclaves, protecting both the model and the data it processes.

- Cryptocurrency wallets can leverage TEEs for secure key storage and transaction signing.

- Oracles, which provide external data to smart contracts, can use TEEs to ensure the integrity of the data they feed into blockchain networks.

f) Post-Quantum Cryptography:

As quantum computers threaten to break current cryptographic standards, both AI and crypto are pushing for quantum-resistant algorithms:

- Blockchain networks are exploring post-quantum cryptography to secure transactions against future quantum attacks.

- AI is being used to develop and test new quantum-resistant encryption methods.

- Hybrid classical-quantum cryptographic systems are being developed to provide long-term security for sensitive AI and financial data.

These privacy-enhancing technologies, combined with AI and crypto, are generating "privacy-by-design" systems. These advances protect user data and enable new collaboration and data sharing that were previously unattainable due to privacy concerns. More complex applications that balance data utility with strict privacy constraints could revolutionize healthcare, finance, and scientific research.

Autonomous Economic Agents:

New autonomous economic agents (AEAs) will make judgments and execute transactions on blockchain networks using predefined rules and real-time data analysis.

a) Definition and Core Concepts:

- AEAs are software agents that can operate independently, make economic decisions, and interact with other agents or humans within a blockchain ecosystem2.

- They combine AI capabilities (such as machine learning and natural language processing) with blockchain features (like smart contracts and tokenization).

- AEAs can own digital assets, enter into agreements, and perform tasks without direct human intervention.

b) Key Capabilities:

- Autonomous Decision Making: AEAs can analyze market conditions, assess risks, and make trading or investment decisions based on sophisticated AI algorithms.

- Smart Contract Interaction: They can automatically initiate, negotiate, and execute smart contracts on blockchain platforms.

- Data Analysis and Prediction: AEAs can process vast amounts of data to predict market trends, optimize resource allocation, or identify investment opportunities.

- Self-improvement: Through machine learning, AEAs can improve their performance over time, adapting to changing market conditions and refining their decision-making processes.

c) Potential Applications:

- Decentralized Finance (DeFi): AEAs could act as automated market makers, liquidity providers, or yield optimizers in DeFi protocols, enhancing efficiency and reducing human error.

- Supply Chain Management: Autonomous agents could manage inventory, negotiate prices, and execute orders across complex supply chains, optimizing for efficiency and cost.

- Energy Markets: In decentralized energy grids, AEAs could buy and sell energy on behalf of households or businesses, optimizing for cost and sustainability.

- Real Estate: AEAs could manage property rentals, handle maintenance requests, and even participate in fractional ownership markets.

- Personal Finance: Acting as AI-powered financial advisors, AEAs could manage individual investment portfolios, automatically rebalancing and executing trades based on the user's goals and risk tolerance.

These agents could transform economic interactions, create new markets, and challenge our understanding of economic systems as they become smarter and more ubiquitous. To address ethical, legal, and security concerns, their creation and execution must be managed carefully.

Democratization of AI:

Blockchain-based platforms could enable decentralized AI marketplaces where developers can sell their models for money.

a) Decentralized AI Marketplaces:

- Concept: These platforms would enable AI developers to publish their models, datasets, and algorithms on a blockchain-based marketplace.

- Tokenization: AI models and datasets could be tokenized, allowing for fractional ownership and more fluid trading of AI assets.

- Smart Contracts: Automated licensing and revenue sharing could be facilitated through smart contracts, ensuring fair compensation for developers.

- Examples: Projects like SingularityNET and Ocean Protocol are pioneering this concept, creating decentralized networks for AI services.

b) Incentivization and Collaboration:

- Reward Mechanisms: Cryptocurrency-based rewards could incentivize developers to create and improve AI models, fostering innovation.

- Collaborative Development: Blockchain could enable transparent, traceable collaboration on AI projects, with contributions rewarded through crypto tokens.

- Crowdsourcing: Decentralized platforms could facilitate the crowdsourcing of data and computing power, democratizing access to resources needed for AI development.

c) Accessibility and Inclusivity:

- Lowered Barriers to Entry: By providing access to pre-trained models and datasets, these platforms could enable smaller players and individuals to participate in AI development2.

- Global Participation: Blockchain's borderless nature could allow developers from anywhere in the world to contribute to and benefit from the AI ecosystem.

- Diverse Applications: Increased accessibility could lead to the development of AI solutions for niche or underserved markets.

d) Transparency and Trust:

- Auditable AI: Blockchain's immutability could provide a transparent record of an AI model's development history, enhancing trust and accountability.

- Verifiable Computations: Zero-knowledge proofs could be used to verify the results of AI computations without revealing the underlying data or model.

- Ethical AI: Transparent development processes could help in identifying and mitigating bias in AI models.

e) Decentralized Compute Power:

- Distributed Training: Blockchain could facilitate the creation of decentralized networks for AI model training, leveraging idle computing resources globally.

- Edge AI: Integration with IoT devices could enable decentralized, edge-based AI computations, enhancing privacy and reducing latency.

- Example: Projects like Golem Network and Oasis Labs aim to create a decentralized supercomputer that could be used for AI training and inference.

Challenges to Integration

Despite the promising outlook for the convergence of AI and cryptocurrency technologies, several significant challenges must be addressed for successful integration.

- Regulatory and Legal Concerns:

-

- Regulatory Uncertainty: The rapid evolution of both AI and crypto technologies often outpaces regulatory frameworks, creating uncertainty for businesses and investors. Also, different jurisdictions have varying approaches to regulating AI and cryptocurrencies, making global integration challenging.

- Securities Laws: There's ongoing debate about whether certain cryptocurrencies should be classified as securities, which could impact their integration with AI systems.

- AI Governance: As AI systems become more autonomous, questions arise about legal liability and accountability for AI-driven decisions in crypto markets.

- Ethical Considerations:

- AI Bias: Ensuring that AI systems operating in crypto markets are free from bias is crucial to maintaining fair and equitable financial systems.

- Transparency: The "black box" nature of some AI algorithms may conflict with the transparency ethos of many blockchain projects.

- Decentralization vs. Control: Balancing the decentralized nature of blockchain with the need for some level of control and governance in AI systems is a complex challenge.

- Market Volatility and Economic Impact:

- Economic Disruption: The automation of financial processes through AI and crypto could lead to job displacement in traditional finance sectors.

- Wealth Concentration: There are concerns that the combination of AI and crypto could exacerbate wealth inequality if not managed properly.

- User Adoption and Education:

- Complexity: The technical complexity of both AI and crypto can be a significant barrier to widespread adoption.

- User Experience: Creating user-friendly interfaces for AI-driven crypto applications that are accessible to non-technical users is challenging.

- Digital Literacy: There's a need for widespread education about both AI and crypto to ensure responsible use and adoption.

- Standardization and Interoperability:

- Lack of Standards: The absence of universal standards for AI-blockchain integration hampers interoperability and widespread adoption.

- Data Standardization: Ensuring that data used by AI systems across different blockchain networks is standardized and compatible is a significant challenge.

- Resistance from Traditional Systems:

- Banking Sector Resistance: Traditional financial institutions may resist the integration of AI and crypto due to perceived threats to their business models.

- Governmental Concerns: Some governments may be hesitant to embrace AI-crypto integration due to concerns about losing absolute control over monetary policy and financial systems.

New issues will develop that require constant attention and innovation. But overcoming these constraints could unlock AI-crypto integration's immense potential, making financial and technological systems more efficient, transparent, and accessible.

Technological Limitations:

These limitations span various aspects of both AI and blockchain technologies:

a) Scalability of Blockchain Technology:

- Transaction Throughput: Many blockchain networks, particularly public ones like Ethereum, face limitations in the number of transactions they can process per second. This can be a significant bottleneck for AI applications that require high-frequency, real-time interactions. The leading layer 1 solution thus far is the Solana blockchain.

- Block Size and Time: The size of blocks and the time taken to create new blocks can limit the amount of data that can be stored and processed on the blockchain, potentially constraining AI operations. Layer 2 solutions on Ethereum looks promising, but the highest security resides on the underlying Ethereum chain.

- Solutions: While solutions like Lightning Network for Bitcoin, single-slot finality (SSF) for Ethereum, and Solana incorporate Firedancer to address speed and scalability, their integration with AI systems presents additional complexities.

b) Algorithmic Bias in AI:

- Data Bias: AI models trained on biased data can perpetuate and amplify existing biases, which is particularly concerning in financial applications.

- Model Bias: The design of AI algorithms themselves can introduce biases, even with unbiased training data.

- Feedback Loops: In decentralized systems, biased AI models could create feedback loops that exacerbate inequalities or market inefficiencies.

c) Transparency and Explainability:

- Black Box AI: Many advanced AI models, particularly deep learning models, operate as "black boxes," making it difficult to understand their decision-making processes. This lack of transparency can be problematic in financial and legal contexts.

- Smart Contract Complexity: As smart contracts become more complex, potentially incorporating AI elements, ensuring their transparency and auditability becomes more challenging.

- Regulatory Compliance: The lack of explainability in AI models can make it difficult to comply with regulations that require transparency in decision-making processes.

d) Interoperability:

- Blockchain Interoperability: Different blockchain networks often can't communicate directly with each other, which can limit the potential of AI systems that need to operate across multiple chains.

- AI-Blockchain Integration: Standardizing the integration of AI models with blockchain networks is still an evolving field, with various competing approaches.

e) Energy Consumption:

- Proof of Work: Many blockchain networks, particularly those using Proof of Work consensus mechanisms, consume large amounts of energy. This can be at odds with the computational requirements of AI systems.

- AI Training: Training large AI models requires significant computational resources and energy, which can be challenging to reconcile with the decentralized nature of many blockchain networks.

- Sustainable Solutions: Expanding grid baseload with multiple sources of energy production and developing energy-efficient consensus mechanisms and AI training methods is crucial for the long-term sustainability.

f) Security and Privacy:

- Privacy-Preserving AI: Developing AI systems that can operate on encrypted data (using techniques like homomorphic encryption or secure multi-party computation) while maintaining the privacy guarantees of blockchain is technically challenging3.

- Quantum Resistance: Both blockchain cryptography and AI systems will need to evolve to resist potential attacks from quantum computers. AI developers who are currently integrating Web3 are confident AI solutions will secure the blockchain even beyond quantum computing.

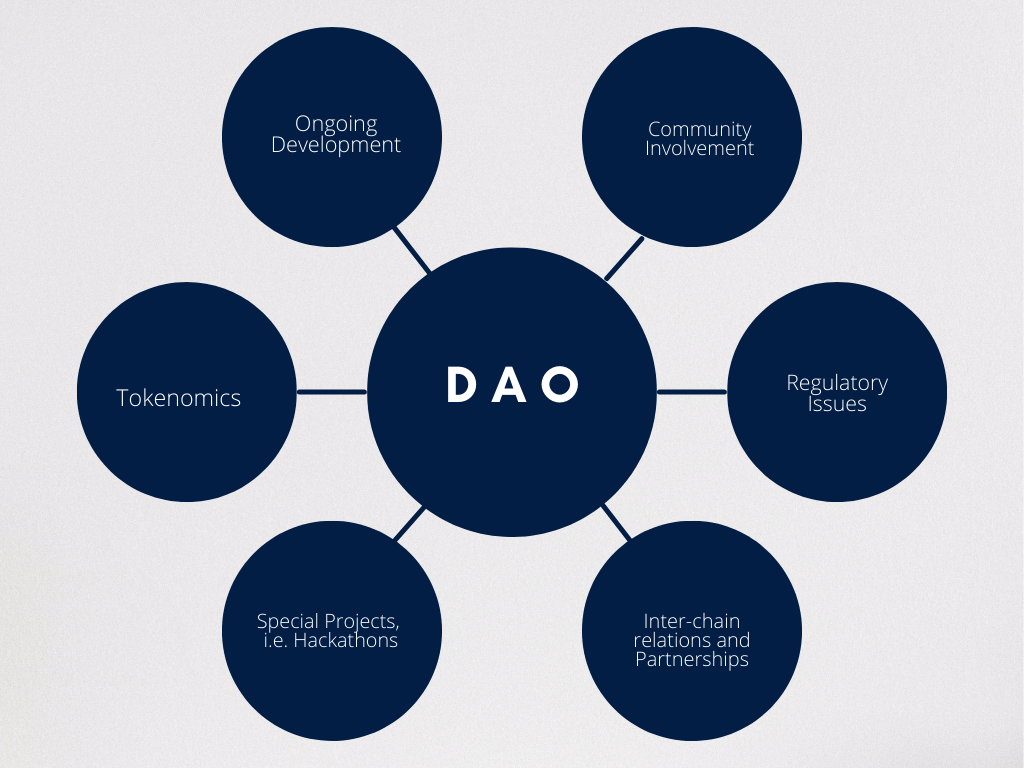

g) Governance and Upgradeability:

- AI Model Updates: Updating AI models in a decentralized environment while maintaining consensus and security is a complex challenge.

- Blockchain Upgrades: Implementing upgrades to blockchain protocols that may affect AI operations requires careful coordination.

- Decentralized Governance: Creating effective governance mechanisms for AI-driven decentralized autonomous organizations (DAOs) is a novel area that will require test environments to perfect.

The Role of Wright's Law in AI-Crypto Convergence

Wright's Law, which states that for every cumulative doubling in production, costs will fall by a constant percentage, is central to the AI-crypto convergence:

- AI Hardware Costs: As production of AI-specific hardware (like GPUs and TPUs) increases, costs are expected to decrease, making AI more accessible.

- Blockchain Scalability: As blockchain networks process more transactions, the cost per transaction is likely to decrease, making crypto more viable for everyday use.

- Learning Curve: As more people use AI and crypto technologies, their collective knowledge and efficiency will improve, further driving adoption.

Conclusion

AI-crypto convergence offers great potential for innovation and social change, giving great opportunities for anyone willing to embrace this new paradigm. By combining these technologies and Wright's Law's cost-cutting power, new applications and efficiencies will arise, changing how we interact with digital assets and intelligent systems.

Whether you're a developer, investor, or simply a curious observer, now is the time to engage with these technologies and help shape the digital economy of tomorrow.

FAQs

How does Wright's Law apply to AI and cryptocurrency convergence?

Wright's Law predicts that for every cumulative doubling in production, costs fall by a constant percentage. This principle suggests that as AI and cryptocurrency technologies scale, their costs will decrease, enabling broader development and adoption.

What are the benefits of AI-enhanced cryptocurrency trading?

AI enhances cryptocurrency trading by analyzing vast datasets to identify trading opportunities and trends, providing sentiment analysis, detecting fraud, and creating personalized investment strategies, all of which will become more accessible as AI costs decrease.

How does blockchain technology support AI development?

Blockchain offers a decentralized framework for AI applications, ensures data integrity, facilitates tokenization for AI development incentives, and enables the secure sharing of AI models and datasets, making data management more efficient and cost-effective.

What future trends can we expect from AI and cryptocurrency integration?

Future trends include increased adoption of cryptocurrencies, transformations across industries such as finance, healthcare, and supply chain management, enhanced privacy and security, AI-powered autonomous agents, and the democratization of AI through blockchain-based platforms.

Donald Trump's Crypto Evolution: Implications for Bitcoin, Crypto, and the 2024 Presidential Election

TLDR

Donald Trump's evolving stance on cryptocurrency from skepticism to advocacy is reshaping the 2024 presidential race. His new pro-crypto position taps into a growing voter base, aligns with Republican free-market principles, and introduces significant potential changes to financial regulations in the U.S.

From Skeptic to Champion: A Calculated Pivot

Donald Trump's recent embrace of cryptocurrency and digital property rights marks a seismic shift in his stance, with far-reaching implications for the 2024 presidential race and the future of digital asset regulation in the US. This dramatic pivot from skepticism to advocacy highlights cryptocurrencies' growing political and economic importance and raises important questions about the future of American financial policy.

During his presidency, Trump was openly skeptical of digital assets, calling them "a scam" and "a disaster waiting to happen." However, his position has dramatically changed in the lead-up to the 2024 election. The Republican Party platform, which Trump edited, now strongly supports cryptocurrency and opposes central bank digital currencies (CBDCs).

Key Moments of Change

Trump's recent speeches and policy proposals underscore his new support for the crypto industry. Notably, Trump’s speech at the Bitcoin 2024 conference in Nashville highlighted his commitment to ending what he called the "unlawful and un-American crypto crackdown." This shift indicates a strategic move to align with the growing influence of the crypto community.

Factors Behind Trump's Strategic Pivot

- Appealing to a Growing Demographic:

The crypto community represents a rapidly expanding and influential voter demographic. By embracing bitcoin and other cryptocurrencies, Trump aims to capture the support of crypto holders and enthusiasts, potentially swaying votes in his favor.

- Aligning with Republican Economic Principles:

The pro-crypto stance aligns perfectly with the Republican Party's emphasis on deregulation and free-market principles. By promising to end the "unlawful and un-American crypto crackdown," Trump appeals to the core tenets of his party's economic ideology. - Unlocking a New Fundraising Avenue:

The crypto industry has become a significant source of campaign contributions. Trump's campaign has reportedly received $25 million in cryptocurrency donations over two months, highlighting the lucrative potential of this fundraising stream. - Positioning as a Pro-Innovation Candidate:

By championing Bitcoin and digital property rights, Trump aims to portray himself as a forward-thinking leader who embraces technological innovation and understands the potential of the digital economy. - Tapping into Anti-CBDC Sentiment:

Trump's staunch opposition to Central Bank Digital Currencies (CBDCs) resonates with conservative anxieties about government surveillance and control over personal finances. This stance positions him as a defender of individual liberty and financial privacy. - Global Competitiveness:

By promising to make the U.S. a "Bitcoin superpower," Trump frames crypto adoption as a matter of national competitiveness. This could influence discussions about America's role in the global financial system.

The Implications of a Crypto-Educated Trump Presidency

Should Trump win the 2024 election, his crypto-friendly policies could have far-reaching consequences:

Regulatory Overhaul

If Trump wins the 2024 presidential election, his administration could push for a comprehensive overhaul of crypto regulations. This might include dismantling existing restrictions and appointing crypto-friendly individuals to key regulatory positions, potentially transforming the financial system.

Bitcoin as a Strategic Asset

Trump has hinted at the possibility of embracing Bitcoin as a strategic asset, potentially challenging the dominance of the US dollar in global finance. This could have significant geopolitical ramifications and reshape the international monetary system. Expanding on this point:

a) Challenging Dollar Hegemony:

By embracing Bitcoin as a strategic asset, the U.S. could be signaling a willingness to diversify its monetary strategy beyond the traditional reliance on the U.S. dollar. This could:

- Reduce the country's vulnerability to potential weaponization of the dollar-based financial system by adversaries. Provide an alternative to the SWIFT system for international transactions, potentially reducing U.S. ability to impose financial sanctions. Encourage other nations to consider similar strategies, potentially accelerating the shift away from dollar dominance.

b) Economic Implications:

The U.S. could potentially benefit from early large-scale adoption of Bitcoin, especially if its value continues to appreciate over time. However, this could also introduce new volatility into the national economic strategy, given Bitcoin's historical price fluctuations. It might lead to a reevaluation of how national wealth and economic power are measured and projected globally.

c) Geopolitical Power Dynamics:

Nations with significant Bitcoin mining operations (like China) could see their geopolitical influence shift. Countries with abundant renewable energy sources could gain strategic importance as ideal locations for Bitcoin mining. The move could be seen as a counter to China's development of the digital yuan, potentially sparking a "crypto race" among global powers.

d) International Monetary System Reshaping:

A U.S. embrace of Bitcoin could accelerate the development of a multi-polar currency world, where no single national currency dominates. It could lead to the creation of new international financial institutions and governance structures to manage a global financial system where cryptocurrencies play a major role. The IMF and World Bank might need to adapt their policies and operations to account for the growing importance of decentralized digital currencies.

e) Technological Sovereignty:

Embracing Bitcoin could spur increased investment in blockchain technology and cryptocurrency infrastructure within the U.S. This could help ensure that the U.S. remains at the forefront of financial technology innovation.

f) Global Trade Dynamics:

Bitcoin as a strategic asset could facilitate new forms of international trade settlement, potentially reducing reliance on traditional currency exchanges. It might enable easier trade with countries currently facing U.S. sanctions, which could be seen as both a benefit and a drawback, depending on the perspective.

g) Domestic Political Implications:

Such a move could face significant opposition from traditional financial institutions and some political factions. It might require a massive public education campaign to explain the strategy to the American public.

h) Cybersecurity Implications:

Elevating Bitcoin to the status of a strategic asset would likely make it an even bigger target for cyberattacks, requiring robust national cybersecurity measures.

Protection of Digital Property Rights

Trump’s focus on digital property rights could lead to new legislation that strengthens ownership and control over digital assets. This would have significant implications for the broader cryptocurrency market, including NFTs and the metaverse.

Expanding on this point:

a) Legal Framework for Digital Assets:

A Trump administration might push for comprehensive legislation to define and protect digital property rights, potentially creating a clearer legal status for cryptocurrencies, NFTs, and other digital assets. This could include establishing standards for proving ownership, transferring digital assets, and resolving disputes over digital property.

b) Impact on NFTs (Non-Fungible Tokens):

Stronger digital property rights could legitimize and boost the NFT market, providing greater legal certainty for creators, buyers, and sellers. It might lead to more mainstream adoption of NFTs in areas like art, music, real estate, and intellectual property rights management. There could be clearer guidelines on copyright and royalties for NFT creators, potentially revolutionizing how digital artists and content creators monetize their work.

c) Metaverse Implications:

Enhanced digital property rights could accelerate the development and adoption of metaverse platforms by providing a solid legal foundation for virtual property ownership. This might lead to increased investment in virtual real estate and digital assets within metaverse environments. It could also raise complex questions about jurisdiction and governance in virtual worlds.

d) Intellectual Property in the Digital Realm:

Strengthened digital property rights might necessitate updates to existing intellectual property laws to better accommodate the unique characteristics of digital assets. This could include new frameworks for managing and enforcing patents, trademarks, and copyrights in purely digital contexts.

e) Cross-Border Implications:

A strong stance on digital property rights in the U.S. could influence international norms and potentially lead to new global agreements on the treatment of digital assets. It might also create challenges in harmonizing U.S. digital property laws with those of other countries, potentially leading to complex international legal scenarios.

f) Impact on Digital Identity:

Enhanced digital property rights could intersect with developments in digital identity, potentially leading to new ways of verifying ownership and identity in the digital space. This might have implications for privacy and data ownership, with individuals potentially gaining more control over their personal data as a form of digital property.

g) Financial Services Innovation:

Clearer digital property rights could spur innovation in financial services, enabling new forms of collateralization using digital assets. This might lead to the development of more sophisticated DeFi (Decentralized Finance) products and services.

h) Challenges in Implementation:

Defining and enforcing digital property rights would likely face technical challenges, particularly in proving ownership and preventing fraud in a decentralized digital environment. There might be resistance from traditional institutions that benefit from the current, less-defined state of digital property rights.

i) Educational Needs:

A significant shift in digital property rights would likely necessitate widespread education initiatives to help the public and businesses understand and navigate the new digital landscape.

j) Impact on Traditional Property Rights:

The strengthening of digital property rights could lead to interesting intersections with traditional property law, potentially blurring the lines between physical and digital ownership in some areas.

Increased Adoption and Innovation

A pro-crypto regulatory environment could accelerate innovation and adoption within the United States, potentially positioning the country as a global leader in the digital economy.

Impact on Traditional Finance

How might a strong pro-crypto stance affect the traditional banking sector and the broader financial system? A strong pro-crypto stance under a potential Trump administration could have significant ripple effects throughout the traditional financial sector:

a) Banking Sector Disruption:

Traditional banks might face increased competition from crypto-native financial services. This could lead to:

- Pressure on banks to innovate and offer crypto-related services to remain competitive.

- Potential loss of market share in areas like international remittances and payment processing.

- Increased investment in blockchain technology by traditional banks to stay relevant.

b) Regulatory Arbitrage:

A more permissive regulatory environment for crypto could create opportunities for regulatory arbitrage, potentially undermining existing financial regulations and creating new systemic risks.

c) Shift in Investment Patterns:

Increased mainstream acceptance of cryptocurrencies could lead to a shift in investment patterns, with more institutional and retail investors allocating portions of their portfolios to digital assets. This could potentially reduce demand for traditional financial products and services.

d) Impact on Monetary Policy:

Widespread adoption of cryptocurrencies, particularly Bitcoin, could complicate the Federal Reserve's ability to implement monetary policy effectively. This could lead to:

- Reduced effectiveness of interest rate adjustments.

- Challenges in managing inflation and economic stability.

e) Financial Inclusion:

Increased access to crypto services could potentially improve financial inclusion, providing banking-like services to underserved populations. This could pressure traditional banks to improve their offerings for these demographics.

f) Cybersecurity Concerns:

A rapid shift towards crypto could expose the financial system to new types of cybersecurity risks, requiring significant investment in new security infrastructure and expertise.

g) International Financial Relations:

A strong pro-crypto stance by the U.S. could influence global financial dynamics, potentially challenging the dominance of the U.S. dollar in international trade and affecting relationships with countries that have stricter crypto regulations.

h) Market Volatility:

The inherent volatility of many cryptocurrencies could introduce new elements of instability into the broader financial system, particularly if they become more intertwined with traditional financial products.

i) Job Market Shifts:

There could be significant shifts in the financial job market, with increased demand for crypto and blockchain expertise, potentially at the expense of traditional banking roles.

These potential effects are significant, but they depend on legislation and crypto acceptance. Over time, the traditional financial industry may adapt, creating a hybrid system that combines crypto and traditional money.

Conclusion: A Defining Issue in 2024

Donald Trump's embrace of crypto advocacy marks a pivotal shift in the 2024 presidential race, underscoring the growing political and economic significance of digital assets. This evolution promises to be a defining issue, potentially reshaping U.S. financial regulation and policy.

While a crypto-friendly administration offers potential benefits, it also presents complex regulatory challenges in a rapidly evolving and volatile sector.

The outcome of this debate could significantly influence the future of American financial policy, making the 2024 election a crucial moment for the trajectory of cryptocurrency in the United States.

FAQs

How has Trump's stance on cryptocurrency changed over time?

Initially skeptical, calling crypto a "scam," Trump has now embraced it, editing the Republican platform to support cryptocurrency and oppose CBDCs.

What factors influenced Trump's new pro-crypto position?

Key factors include appealing to a growing crypto voter base, aligning with Republican deregulation principles, unlocking new fundraising avenues, and opposing CBDCs.

What could a crypto-friendly Trump presidency mean for the U.S.?

It could lead to regulatory overhauls, increased adoption and innovation, protection of digital property rights, and potentially significant geopolitical ramifications.

What challenges could arise from Trump's crypto stance?

Challenges include balancing innovation with consumer protection, international coordination, implementation hurdles, and potential impacts on traditional finance.

Maximizing Staking Rewards with Effective Strategies

Maximize Your Crypto Staking Rewards: Strategies for Higher Returns

Staking cryptocurrencies has become an increasingly popular way for investors to earn passive income by supporting blockchain networks. Users stake coins and tokens to secure blockchain networks and earn staking rewards in return. However, simply staking your coins is not enough – maximizing your staking rewards requires careful planning and strategic decision-making.

Understanding the Basics of Crypto Staking

Staking involves holding coins in a digital wallet for a fixed period of time to participate in blockchain operations. While benefiting from the possible organic growth in coin value, stakers also earn additional rewards, making it comparable to earning interest on an investment.

Proof-of-Stake (PoS) consensus algorithms like Delegated Proof of Stake (DPoS) and Leased Proof of Stake (LPoS) are used to randomly select validators to create new blocks based on their staked holdings.

How Does Staking Work?

It's not just about pressing the 'stake' button and waiting for profits to roll in. Staking runs on "Proof of Stake" (PoS) consensus algorithms and its many variants such as Delegated Proof of Stake (DPoS), Leased Proof Of Stake (LPoS), etc. In PoS-based blockchains, validators are chosen randomly by the algorithm to create blocks based on the number of coins they hold and are willing to 'stake' as collateral.

| Type | Description |

|---|---|

| PoS (Proof-of-Stake) | Validators are randomly selected to create blocks. |

| dPoS (Delegated-Proof-of-Stake) | Allows users to vote for 'node representatives' who can then take part in block creation. |

| LPoS (Leased-Proof-of-Stake) | Calculates odds based upon total staking amount and the time duration it has been staked. |

Why Stake?

Staking crypto offers several advantages. You can grow your holdings with minimal effort, benefiting from potential market returns. Stakers earn rewards by securing transaction validations and often participate in network upgrades and votes. Additionally, staking has less downtime risk compared to traditional mining.

- Ease of Earning: Grow your holdings with relatively lower effort.

- Taking Control: Have a say over network upgrades and developments.

- Downtime Risk: Experience lower downtime risk relative to traditional mining methods.

- Growth: Cryptocurrency holdings increase over time.

Importance of Research in Maximizing Staking Rewards

Every investor should primarily focus on researching for the right crypto asset. Not all cryptocurrencies offer staking opportunities. Therefore, it's key to identify which coins enable staking and offer high return-on-investment (ROI).

Each crypto-asset has unique performance histories, future developments, and community support, all affecting its value. Researching network rates, such as inflation and interest rates, provides insights into potential profits. Key factors include the chosen crypto-asset, network rates, market dynamics, and suitable staking platforms.

| Crypto Asset | Inflation Rate | Interest Rate |

|---|---|---|

| Ethereum 2.0 | 1-3% | 6% |

| POLKADOT (DOT) | 10% | 16% |

Strategic Selection of Profitable Cryptocurrencies for Staking

When selecting cryptocurrencies for staking, it is crucial to evaluate several key factors to maximize profitability while managing risks effectively. Here are some important considerations:

Annual Percentage Yield (APY)

The APY represents the potential annual returns you can earn by staking a particular cryptocurrency. Generally, a higher APY is more desirable, but it may also indicate higher risk. Compare the APYs across different cryptocurrencies to gauge their relative profitability:

| Crypto | APY |

|---|---|

| Cardano (ADA) | 5.5% |

| Solana (SOL) | 6.7% |

| Polkadot (DOT) | 14% |

While Polkadot offers a higher APY, it's essential to consider other factors like stability and project sustainability.

Stability and Project Sustainability

Evaluate the stability and long-term viability of the cryptocurrency project. A well-established project with a strong development team, active community, and real-world use cases is generally more desirable for staking. Unstable or speculative projects may offer higher APYs but carry higher risks of price volatility or project failure.[1]

Staking Requirements

Different cryptocurrencies have varying staking requirements, such as minimum holding amounts, specific wallets or hardware, or lockup periods. Ensure you can meet these requirements before committing to staking:

| Crypto | Staking Requirements |

|---|---|

| Ethereum (ETH) | 32 ETH, specific software |

| Tezos (XTZ) | 8,000 XTZ or delegation to a baker |

| Cosmos (ATOM) | Delegation to validators, no minimum |

Failing to meet the requirements may result in penalties or missed rewards.

Unstaking Penalties and Lockup Periods

Some cryptocurrencies impose penalties or lockup periods if you unstake (withdraw your stake) before a certain time. Consider your liquidity needs and the potential impact of these restrictions on your investment strategy.

By carefully evaluating these factors, you can make informed decisions about which cryptocurrencies to stake, balancing profitability with risk tolerance and investment goals. Diversifying your staking portfolio across multiple cryptocurrencies can also help mitigate risks.

Keys to Optimal Stake Pool Selection for Higher Returns

The first important factor is the performance of the pool. Always investigate how a specific stake pool has been performing in terms of distribution interruptions, variable rewards and inconsistent returns. While past performance is not a guarantee of future results, it does give some idea about its efficiency and reliability.

Another critical element to consider is the pool’s saturation level. Saturation represents how much total stake a single pool has acquired. If the pool has a high degree of saturation, there's a good chance that it may yield less return per unit stake. Therefore, it is advisable to join a moderately saturated yet promising pool for higher profitability.

- Pool Size: Although larger pools seem more promising due to their network stability, small pools often offer higher rewards because fewer people share them.

- Variable Fee: This is calculated as a percentage of all rewards earned by stakeholders. Pools with lower variable fees often provide better long-term profits.

- Pledge: It refers to the amount of personal cryptocurrency the pool's creator has put into their own pool (mostly for younger projects). A higher pledge amount typically indicates more commitment towards their own venture.

| Key Factors | Description |

|---|---|

| Performance | Indicates efficiency and reliability based on past stats |

| Saturation Level | Reflects the total stake a pool has accrued |

| Pool Size | Greater size can mean more network stability but potentially lower individual rewards |

| Variable Fee | A percentage of all rewards, lower is usually better for long-term profits |

| Pledge | The pool creators' personal cryptocurrency put into the pool as a sign of commitment. |

Considering all these factors before staking your digital assets can allow you to optimize your investment strategy and maximize your returns. Start with detailed research and consider diversifying across different pools to manage risk effectively.

Best Practices for Risk Management in Crypto Staking

Staking in the crypto arena has the potential for high returns, yet just as with any other investment, it is critical to align strategies with best practices to mitigate risk. Understanding these can provide a greater level of security, protect your asset value and optimise your profits. Here are a few key steps you can adopt to manage risk effectively while staking.

Firstly, diversification is key. Spreading assets across more than one project diminishes the negative impact should one of these projects fail or has disruptions. Just as you wouldn't put all of your eggs in one basket when investing in traditional spheres such as stocks or real estate, the same principle applies.

- Research: Spend adequate time understanding the various projects on offer before deciding where to stake your tokens.

- Analyse Past Performance: This will give you an insight into project stability and future perspective.

- Select a Varied Portfolio: By selecting different types of products that offer different benefits or operate within various sectors, you enable spread risk.

Secondly, it's crucial to clearly understand the terms and conditions associated with each staking agreement. Some staking providers impose penalties for early withdrawal or switching between validators. Be sure to read through all terms thoroughly before committing your tokens into a staking contract.

| Terms | Definition |

|---|---|

| 'Lock up' Duration | Period after which your tokens are not redeemable. |

| Validator Fees | Costs incurred to validate a transaction; it is typically a percentage of the rewards earned by you. |

Lastly, ensure to safeguard your security keys. Staking on a centralized platform is unsecure, as others are in control of the wallet keys. With decentralized finance (DeFi) your stake and rewards are tied to the secret key only you have. The risk of DeFi is if keys are lost, it's almost impossible to recover the funds. Therefore, it's advised always to keep multiple copies of your keys and store them in different secure locations.

Implementing Advanced Strategies to Maximize Staking Profits

Staking has been rising in popularity as one of the best ways to earn passive income in the cryptocurrency sector. However, to take full advantage and maximize your profits, you should employ advanced staking strategies. Instead of simply contributing your assets to any available pool, make certain considerations to optimize returns.

Choosing a Gravitating Pool: Not all staking pools are equal across parameters like reliability, fees, and rewards distribution policies. Consider aspects such as the size of the pool (a larger one improves chances of being chosen for block validation), past performance (check if the pool has been consistently generating blocks), costs involved (transaction fees and commission that can eat into profits), and uptime (as frequent downtime can lower rewards).

Ongoing Monitoring & Reinvestment: A common mistake that participants make is 'set it and forget it'. This approach can potentially lead to decreased profits over time due to variable transaction fees or changes in validation selection probabilities. Having an ongoing monitoring system helps track a pool’s performance and take decisions such as reinvesting earned interest back into the staking pool or shifting assets to other more profitable pools.

| Action | Description |

|---|---|

| Initial Staking | Selecting a viable stake pool based on stringent parameters for optimized returns. |

| Ongoing Monitoring | Maintaining a vigil on rewards generation and related variables for proactive decision-making. |

| Reinvestment Strategy | Tactfully reinvesting earned interest to compound staking profits. |

Moreover, the use of staking calculators can also significantly enhance the decision-making process. These tools provide estimates of possible future earnings based on several factors like staking duration, amount to be staked, and annual yield. Employing such advanced strategies in your staking endeavors can ensure maximized returns and a steady stream of passive income. Remember that as much as staking is relatively less risky compared to trading, doing some due diligence is always worthwhile.

Future Outlook

implementing effective staking strategies is crucial for maximizing your rewards in the crypto space. By diversifying your assets, staying informed about market trends, and choosing reputable staking platforms, you can significantly increase your returns. Remember to always prioritize security and research before making any staking decisions. With the right approach and dedication, you can make the most out of your staking rewards and grow your crypto portfolio efficiently. Happy staking!

10 Steps You Need to Pick Winning Crypto Projects

The journey to identifying and investing in promising cryptocurrency projects demands more than just a superficial glance. Engaging deeply with the project’s fundamentals and aligning with the vibrant Web3 community is not just advisable; it's essential.

This guide introduces a 10-step action list designed to streamline the process of identifying and capitalizing on elite cryptocurrency projects, emphasizing the indispensable role of thorough due diligence and robust community engagement. Whether you're a seasoned investor or new to the blockchain world, grasping the core technology, the strategic vision of the team, and the economic principles governing the tokens through detailed analysis, all while engaging with the ongoing dialogue and innovation within the community, is essential.

Such immersion not only enriches your investment approach but also enhances your ability to discern between fleeting trends and genuinely transformative opportunities in the Web3 space.

Step 1: Define Your Investment Goals

Before diving into any cryptocurrency investment or building a crypto portfolio, clearly define your financial goals, risk tolerance, and investment timeline. For example:

- Short-term goals may focus on investing in new crypto projects, ICOs, or high volatility tokens for quick gains.

- Long-term goals may lean towards established cryptocurrencies like Bitcoin or Ethereum with stable growth.

Step 2: Conduct Comprehensive Research

Research the crypto project thoroughly, including understanding the problem it addresses, its blockchain technology, roadmap, and whitepaper. A real-world example of this importance is the rise of Ethereum, which was backed by:

- A strong whitepaper outlining the development of smart contracts.

- A clear roadmap that revolutionized blockchain utilities like DeFi.

Step 3: Analyze Tokenomics

Investigate the token's utility, total and circulating supply, and any deflationary mechanisms. For instance, projects like Binance Coin (BNB) have successfully implemented:

Investigate the token's utility, total and circulating supply, and any deflationary mechanisms. For instance, projects like Binance Coin (BNB) have successfully implemented:

- Token burns, which have historically benefited the token price and ecosystem growth.

- Deflationary mechanisms that reduce the token supply over time.

Ethereum's deflationary mechanism refers to the changes in its economic model that have led to a decrease in the overall supply of Ether (ETH), the native cryptocurrency of the Ethereum network. This shift occurred primarily due to two significant updates:

- The Merge: In September 2022, Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism with an event known as "The Merge". This drastically reduced the rate at which new ETH is created.

- EIP-1559: The Ethereum Improvement Proposal 1559, implemented in August 2021, introduced a transaction fee-burning mechanism. A portion of the transaction fees, instead of going to miners, is now "burned" or permanently removed from circulation. As a result of these updates, the number of ETH being burned in transaction fees often exceeds the number of new ETH being created for network rewards. This has led to periods where the supply of ETH decreases over time, hence the term "deflationary" as opposed to "inflationary," where the supply would be increasing.

Step 4: Assess the Development Team

Evaluate the credibility, expertise, and track record of the project's development team. Successful teams include the following qualities:

- Projects with teams that have previously created and sustained successful cryptocurrencies.

- A strong development team must have open and transparent communication in order to work cohesively and efficiently towards a goal while responding to community sentiment.

- Adaptability is key in the fast-paced world of technology, as teams must be able to quickly adjust to changing requirements, technologies, and priorities.

Step 5: Understand the Project's Market Niche

Determine how the crypto project compares to its competitors and its unique selling proposition (USP). For example, Solana offers:

- High throughput and low transaction costs, positioning it uniquely against other layer-1 solutions.

- A USP that addresses the scalability issues faced by other blockchain networks like Bitcoin and Ethereum.

Step 6: Review Market Performance and Historical Data

Look at the token's price stability, market cap trends, and trading volume. This can help gauge the cryptocurrency market's sentiment and the project's viability. For instance:

- Observing patterns in similar projects like EVM Layer 2's could provide insights into market behavior and potential future performance.

- Analyzing historical crypto data can reveal trends and potential entry/exit points for investments.

Step 7: Gauge Community and Ecosystem Support

A vibrant, engaged community and a growing list of partnerships can indicate a healthy project ecosystem. For example:

- The strong community support and developer activity around Polkadot are significant indicators of its robust ecosystem.

- Projects with active social media presence, forums, and developer communities tend to have better long-term prospects.

Step 8: Stay Updated on Regulatory News

Keeping abreast of regulatory developments is crucial, as seen with XRP, where regulatory news has significantly impacted its market performance. Ensure the crypto project:

Keeping abreast of regulatory developments is crucial, as seen with XRP, where regulatory news has significantly impacted its market performance. Ensure the crypto project:

- Complies with the laws of the jurisdictions it operates within.

- Provides clear answers to all inquiries, whether in a spirit of complicity or dissidence.

- Has a clear strategy to navigate regulatory challenges.

Step 9: Practice Risk Management

Diversify your cryptocurrency investments to manage risk effectively. Do not over-invest in any single project. Instead, spread your capital across various assets to mitigate potential losses. Crypto is subdividing into sub-set markets, and there is usually a strong lead project in each:

- Layer 1's

- Layer 2's

- Ethereum Virtual Machine (EVM) blockchains

- Cosmos ecosystem

- Solana ecosystem

- Meme coins

- Gaming

- DePIN (Decentralized Physical Infrastructure Networks)

- Etc. There is usually a product lead in each category.

Step 10: Continuous Monitoring and Reassessment

Regularly monitor the crypto project's progress against its roadmap, updates from the team, and ongoing market conditions. Active engagement can help you decide when to adjust your cryptocurrency holdings, similar to how:

- Early Bitcoin adopters have had to reassess their investment after each halving and with the evolution of the crypto market.

- Successful crypto investors continuously reevaluate their portfolio based on changing market dynamics.

This action list provides a structured approach to investing in cryptocurrency projects and the new asset class, drawing from real-world examples that highlight the significance of each step. By following these steps, investors can enhance their decision-making process and potentially increase their chances of investing in successful projects that offer unique value propositions and potential for long-term growth.

The information contained herein is for informational purposes only and should not be construed as investment advice or recommendations for making any financial decisions. Your situation is unique, and you should always do your own research, consult with industry experts, and be wary of projects that sound too good to be true. This information may not be accurate or timely, and the author or Investopedia may receive compensation from offers that appear on this site.

Beyond Bitcoin Halving: The Future of Crypto Post-Halving.

TLDR

- Understanding the mechanism and historical influence of Bitcoin halving.

- Analyzing the anticipated effects of the 2024 Bitcoin halving on investment dynamics.

- Highlighting technological advancements and strategies relevant post-halving.

- Evaluating potential risks and formulating strategic responses for investors.

Introduction

Bitcoin, the pioneer of cryptocurrencies, has introduced a unique economic model characterized by periodic 'halving' events. These milestones are pivotal moments where the reward for mining new blocks is halved, thus reducing the rate at which new bitcoins are introduced into the system. As we approach the 2024 halving, understanding its implications is crucial for both seasoned investors and newcomers to the cryptocurrency space.

The halving mechanism is a key feature of Bitcoin's design, aimed at controlling the digital currency's long-term supply and inflation rate. By periodically reducing the mining reward, the protocol ensures that the total supply of Bitcoin will eventually reach its cap of 21 million coins, making it a truly scarce asset in the digital realm.

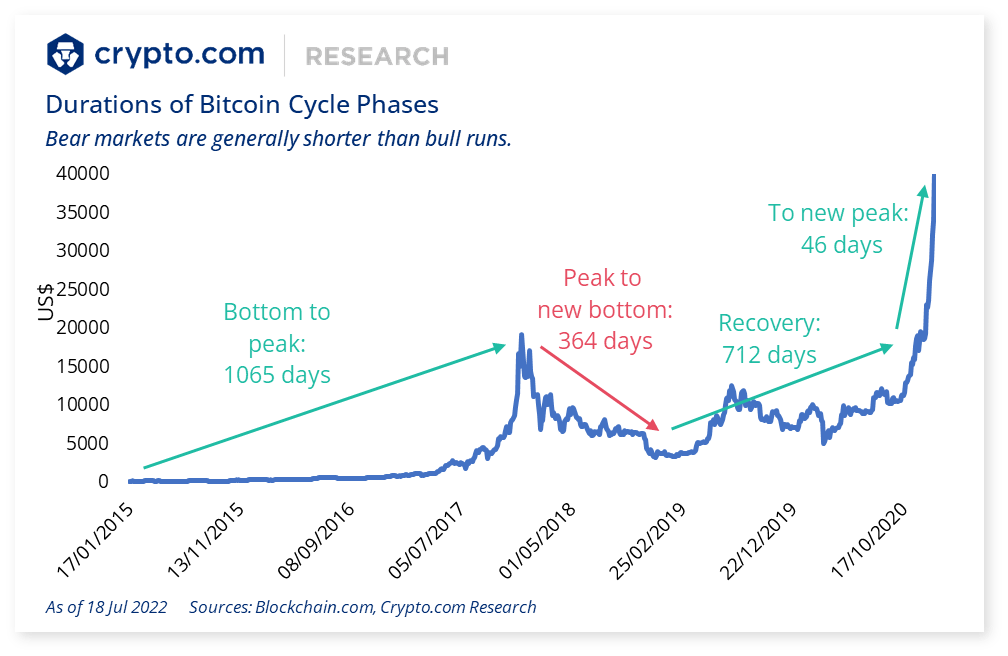

Historical Analysis of Bitcoin Halvings

Historically, Bitcoin halvings have been watershed events that significantly influence the cryptocurrency's price and market dynamics. Following the first halving in 2012 and the subsequent ones in 2016 and 2020, bull runs propelled Bitcoin to new all-time highs. These patterns underscore the potential market movements post-2024 halving, although past performance is not indicative of future behavior.

The impact of previous halvings can be attributed to the basic economic principles of supply and demand. As the supply of new Bitcoin decreases due to reduced mining rewards, scarcity increases, potentially driving up prices if demand remains strong or increases. This dynamic has been a key factor in shaping investor sentiment and market behavior around halving events.

Economic Implications of Bitcoin Halving

The halving events are designed to create scarcity, a fundamental economic principle that underpins Bitcoin's value proposition. As the reward for mining decreases, the scarcity of Bitcoin increases, which could potentially drive up its price, assuming demand remains strong or increases.

However, it's important to note that scarcity alone does not guarantee price appreciation. Other factors, such as global economic conditions, regulatory developments, and competition from other cryptocurrencies, also play a significant role in shaping Bitcoin's value. The halving event's impact on price can be amplified or dampened by these external factors.

Institutional and Retail Investment Trends Post-Halving

In the aftermath of the 2024 Bitcoin halving, both institutional and retail investors are expected to closely monitor the market dynamics and adapt their strategies accordingly. Historically, halvings have been catalysts for significant price movements, peaking about 6 months post-halving.

Institutional investors, such as hedge funds, family offices, and corporate treasuries, may view the post-halving period as an opportune time to accumulate Bitcoin holdings. With the reduced supply of new coins entering circulation, institutions should now perceive Bitcoin as truly a scarce asset with long-term value appreciation potential.

Furthermore, 2024 is an election year, and with more citizen awareness of digital assets, there should be more crypto-favorable politicians in this cycle. With stronger positive crypto representation, regulatory developments could pivot dramatically. Clear guidelines and oversight mechanisms could provide the necessary confidence and legitimacy for larger players to embrace digital assets as part of their portfolios.

On the retail side, the halving event itself and the subsequent market movements usually attract a new wave of individual investors seeking to capitalize on the potential for price appreciation. The largest marketing campaign for Bitcoin within retail markets is the price itself.

During the post-halving period, we can expect to see a surge in interest and participation from various investors, each with their own unique motivations and strategies. The interaction between institutional and retail demand will play a crucial role in shaping the market dynamics and could potentially drive the price of Bitcoin beyond 2024 and well into 2025.

Technological Advancements Post-Halving

Post-halving, we can expect continued advancements in blockchain technology, enhancing transaction efficiency and security. These innovations will be crucial for Bitcoin to scale effectively and maintain its position at the forefront of the cryptocurrency market.

One of the most anticipated developments is the Lightning Network, a second-layer scaling solution that enables near-instant and low-cost transactions. The implementation of the Lightning Network could potentially address scalability issues and facilitate Bitcoin's wider adoption as a medium of exchange for everyday transactions.

Regulatory and Legal Landscape

In 2022, President Biden signed an executive order directing federal agencies to develop a comprehensive regulatory framework for cryptocurrencies. This move signaled the administration's recognition of the growing importance of digital assets and the need for a cohesive regulatory approach.

The SEC has taken a firm stance on classifying certain cryptocurrencies as securities, subjecting them to stringent disclosure and registration requirements. This approach supposedly aims to protect investors from fraudulent practices and ensure transparency in the crypto market. However, some industry players argue that excessive regulation stifles positive innovations and places undo limitations on blockchain technology.

On the other hand, the CFTC has been more accommodating towards cryptocurrencies, recognizing them as commodities and allowing the trading of Bitcoin and Ethereum futures on regulated exchanges. This stance has provided a degree of freedom for digital assets and facilitated their integration into traditional financial markets.

After the 2024 Bitcoin halving, the regulatory landscape in the United States will play a crucial role in shaping market sentiment and investor confidence. The current overly restrictive measures hinder adoption and dampen market enthusiasm.

The United States and other major economies should strive to implement balanced and innovative cryptocurrency regulations. Yes, regulations should aim to protect consumers and prevent illicit activities, yet they must foster innovation and allow the cryptocurrency industry to thrive. The ongoing efforts by various government agencies to establish clear guidelines and oversight mechanisms suggest that the United States is slowly moving towards a more comprehensive regulatory framework for cryptocurrencies. However, the specific details and the extent of regulations will ultimately determine the level of adoption and integration of digital assets into the traditional financial system.

Global Economic Factors Influencing Bitcoin's Trajectory

Global economic conditions, such as inflation rates, monetary policy changes, and economic downturns, play a significant role in shaping Bitcoin's attractiveness as an alternative investment. As a non-sovereign asset, Bitcoin has the potential to act as a hedge against fiat currency devaluation.

In times of economic uncertainty or high inflation, investors may turn to Bitcoin as a store of value, driving up demand and potentially contributing to price appreciation. Conversely, during periods of economic stability and low inflation, most investors treat Bitcoin similarly to a tech stock innovation, which could push the asset to the top of the S-curve faster than most tech adoption curves of the past.

Increasing Competitiveness in Bitcoin Mining

The Bitcoin mining landscape is becoming fiercely competitive, pushing miners to continually innovate and seek out the most efficient and cost-effective energy solutions. This drive for efficiency is a response to decreasing block rewards and a necessity in a maturing market where operational margins can be thin.

As mining difficulty increases and rewards decrease, miners will need to leverage the latest hardware and energy-efficient mining techniques to remain profitable. This competitive environment may lead to further consolidation, with larger mining operations potentially dominating the market, raising concerns about centralization.

Strategic Investment Approaches

Investors looking to leverage the halving event should consider diversifying their portfolios to include Bitcoin if they have not already. A strategic approach would involve balancing the potential high rewards against the volatility and risks inherent in cryptocurrency investments.

One common strategy is to employ dollar-cost averaging, which involves investing a fixed amount at regular intervals, regardless of market conditions. This approach can help mitigate the impact of price fluctuations and potentially lower the overall investment cost over time.

The Role of Bitcoin ETFs and Financial Products

The emergence of Bitcoin ETFs has made it easier for individuals to invest in Bitcoin without dealing with the technical challenges of handling cryptocurrencies directly. These financial products will likely expand, offering more options and potentially driving further adoption.

Bitcoin ETFs provide a regulated and convenient way for institutional and retail investors to gain exposure to the cryptocurrency market. Now, savvy investors are focused on other digital assets, such as Ethereum, gaining approval for ETF implementation.

Future of Bitcoin and Cryptocurrency Ecosystem

Looking ahead, Bitcoin is poised to remain a significant player in the financial landscape. Its integration into broader financial systems, combined with the maturation of blockchain technologies, suggests a promising future.

As the world becomes increasingly digitized, the demand for decentralized, secure, and transparent financial systems will grow. Bitcoin, with its established network and first-mover advantage, will play a pivotal role in shaping the future of digital finance, provided it continues to evolve and address scalability, transaction speed, and transaction cost issues.

Conclusion

As the 2024 Bitcoin halving approaches, the cryptocurrency community stands at a crossroads that could define the future trajectory of Bitcoin and its underlying technology. For investors, staying informed and adaptable will be key to navigating this exciting yet challenging market.

By understanding the potential impacts of the halving on market dynamics, regulatory developments, and investment trends, investors can make more informed decisions and position themselves accordingly.

Frequently Asked Questions (FAQs)

What is Bitcoin halving?

Bitcoin halving is an event that halves the rate at which new Bitcoins are created. It occurs once every 210,000 blocks, roughly every four years, reducing the block reward given to miners for processing transactions. The next halving is expected in 2024, where the reward will decrease from 6.25 to 3.125 BTC.

The halving mechanism is a crucial aspect of Bitcoin's design, aimed at controlling the digital currency's long-term supply and inflation rate. By periodically reducing the mining reward, the protocol ensures that the total supply of Bitcoin will eventually reach its cap of 21 million coins, making it a truly scarce asset in the digital realm.

Why does Bitcoin halving affect the price?

Bitcoin halving affects the price due to the basic economic principle of supply and demand. If the rate of new supply (i.e., the mining of new Bitcoin) decreases, and demand remains constant or increases, the price is likely to rise. Historically, each halving has been followed by a bull run in the Bitcoin market, although past performance is not indicative of future results.

Can Bitcoin halving lead to increased market volatility?

Yes, Bitcoin halving can lead to increased market volatility. This volatility typically arises from speculative trading and investor expectations leading up to and following the halving event. Investors often adjust their positions based on their predictions of how the halving will impact Bitcoin's price, contributing to price fluctuations.

Additionally, the decreased mining rewards post-halving may lead to a temporary reduction in the network's overall computing power, as some miners might find it unprofitable to continue operations. This temporary decrease in network security could contribute to short-term price volatility.

How should investors prepare for Bitcoin halving?

Investors should consider reviewing their investment strategies and possibly diversifying their

2024's Guide to Risk Management in Staking Digital Assets

Introduction

Staking digital assets is an increasingly popular activity in the cryptocurrency world. It involves holding funds in a cryptocurrency wallet to support blockchain operations while earning rewards. But as the industry grows, understanding and implementing effective risk management strategies becomes crucial to safeguarding investments and maximizing returns.

The Allure and Risks of Staking Digital Assets

Staking offers attractive rewards but comes with inherent risks. Understanding these risks is essential for effective management. Key risks include:

- Volatility Risk: The value of staked digital assets and rewards can fluctuate significantly due to market volatility.

- Security Risk: Staked assets face threats like hacking and blockchain vulnerabilities.

- Network Risks: Events such as congestion, upgrades, or hard forks can impact staking performance.

- Liquidity Risks: Difficulty in liquidating holdings quickly if needed.

Mitigating Risks in Digital Asset Staking

Adopting risk management strategies is vital to protect against losses and secure long-term profitability.

- Diversification of Assets: Spread stakes across multiple networks to reduce the risks inherent in any single one.

- Utilizing Insurance Products: Protect against losses from security breaches and other staking-specific risks.

- Active Participation in Governance: Influence network decisions and stay informed about potential risks.

- Continuous Risk Monitoring: Regularly assess risks to proactively address vulnerabilities.

- Setting Risk Tolerance Levels: Determine acceptable risk levels based on potential impact and personal risk tolerance.

Case Studies: Risk Management in Action

Diversification Benefits and Risks

Diversification is a cornerstone strategy in risk management. By spreading investments across various digital assets, blockchain networks, and even different forms of cryptocurrencies like stablecoins or Ethereum, investors can reduce their exposure to the failure or underperformance of a single asset.

However, diversification carries its own set of risks. The most prominent is the dilution of rewards. When assets are spread thin across multiple platforms, the potential gains from any one investment are reduced. Moreover, managing a diversified portfolio requires more time and expertise, especially in understanding the nuances of each asset class. Investors should also be wary of over-diversification, where the sheer number of investments makes effective monitoring challenging, potentially leading to suboptimal decisions.

Insurance Products

As digital asset staking becomes more mainstream, insurance products have emerged to mitigate specific risks associated with this investment method. These products offer protection against a range of events, including security breaches, custodial risks, and even smart contract failures.

However, investors must exercise due diligence when choosing insurance products. It's crucial to carefully examine the terms and conditions of each policy, understanding what is covered and what isn't. Premium costs should be weighed against the potential benefits, keeping in mind that insurance should complement, not replace, other risk management strategies. Furthermore, the reputation and financial stability of the insurance provider are essential considerations, as these factors impact the likelihood of a successful claim settlement in case of an adverse event.

Future Trends in Staking Risk Management

The future of staking risk management is poised to be shaped by several emerging trends and innovations, offering new approaches to handling the inherent risks of staking digital assets.

- The Rise of Staking Pools: Staking pools, where investors combine resources to increase reward chances, democratize reward distribution, allowing even small-scale investors to benefit. However, they pose questions about decentralization and the balance between accessibility and control.

- Derivative Staking: This trend involves creating financial products linked to staked assets. Derivative staking allows investors to receive a derivative token in return for staked tokens, providing liquidity for assets usually locked up during staking periods【25†source】.